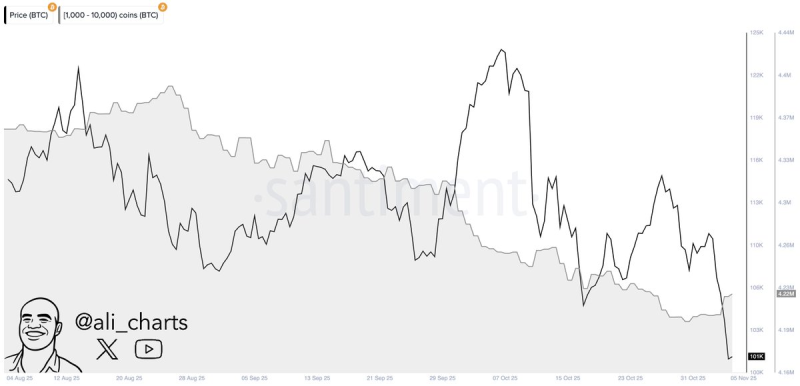

● The data from Santiment reveals an interesting contrast. While these large holders (wallets with 1,000–10,000 BTC) have been gradually selling off through September and October, this sudden 24-hour buying spree stands out. It's a short-term move that breaks from the recent downward trend.

● The crypto industry is facing potential tax changes that have everyone nervous. Policymakers are considering new rules that could hit digital asset businesses hard. Smaller companies might not survive the pressure, and there's real concern about talent leaving for more crypto-friendly countries.

● Budget officials are pushing these changes to close revenue gaps. Their solution? Tax blockchain activities more heavily. But industry voices are pushing back, arguing it makes more sense to raise standard profit taxes instead of targeting mining, staking, or exchanges specifically. They say this would bring in revenue without killing innovation.

● Beyond taxes, lawmakers are also tweaking how companies calculate profits and how individuals report income from digital assets. Without proper transition periods, these changes could backfire—reducing employment and actually shrinking the tax base over time.

● Even with all this uncertainty and market volatility, whales are making their move. This 10,000+ BTC purchase shows that big players are positioning themselves strategically. Whether it's confidence in Bitcoin's long-term prospects or just opportunistic buying during uncertain times, large holders are clearly accumulating at what they see as a critical moment.

Peter Smith

Peter Smith

Peter Smith

Peter Smith