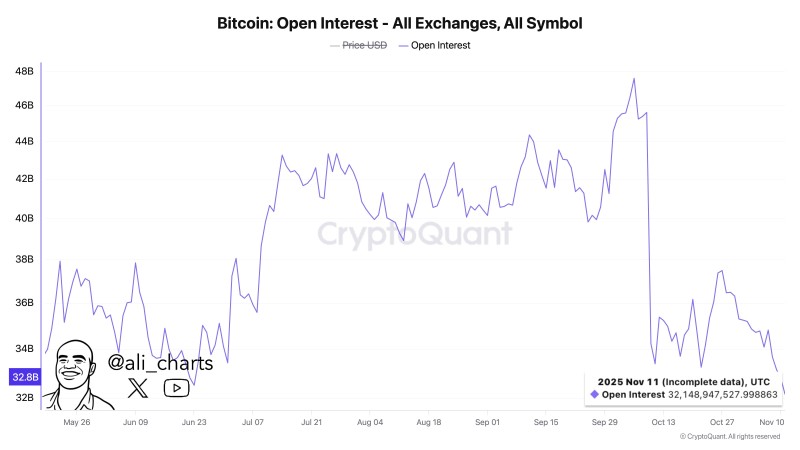

⬤ Bitcoin's open interest across all exchanges has fallen to its lowest point in seven months, according to recent on-chain data from CryptoQuant. As of November 11, 2025, open interest sits around $32 billion—a sharp drop from the $47–48 billion peak seen in late September. This marks a significant cooling in leveraged trading activity as traders either take profits or step back from risk.

⬤ Open interest measures the total value of outstanding futures and perpetual contracts, making it a key gauge of speculative activity in crypto derivatives. The steep decline over the past month suggests widespread position liquidations or deliberate de-risking, with traders closing out leveraged bets amid recent volatility.

⬤ Lower open interest can mean different things. Sometimes it's profit-taking after a wild run. Other times it's caution ahead of uncertain macro conditions. While reduced leverage often brings short-term stability, it can also signal fading momentum in speculative markets. If open interest keeps dropping, liquidity could thin out—making the market more vulnerable to sharp swings during news events or sudden price moves.

⬤ Historical patterns show that dips in open interest often lead to consolidation periods, sometimes followed by strong directional moves once confidence and liquidity return. For now, Bitcoin traders seem to be sitting on the sidelines, waiting for clearer signals. With open interest back near $32 billion, the market appears to be resetting—potentially shifting focus from leveraged plays to spot demand. Whether this is just a pause or the start of a new accumulation cycle is still up in the air.

Peter Smith

Peter Smith

Peter Smith

Peter Smith