Bitcoin can't seem to catch a break. As Wall Street braced for another choppy session, BTC moved in near-perfect lockstep with risk assets — dropping alongside equity futures, bleeding ETF flows, and watching the fear gauge sink to its lowest readings of the year. The synchronized selloff highlights just how closely tied crypto remains to the broader macro environment.

Bitcoin and Stocks Move as One — Again

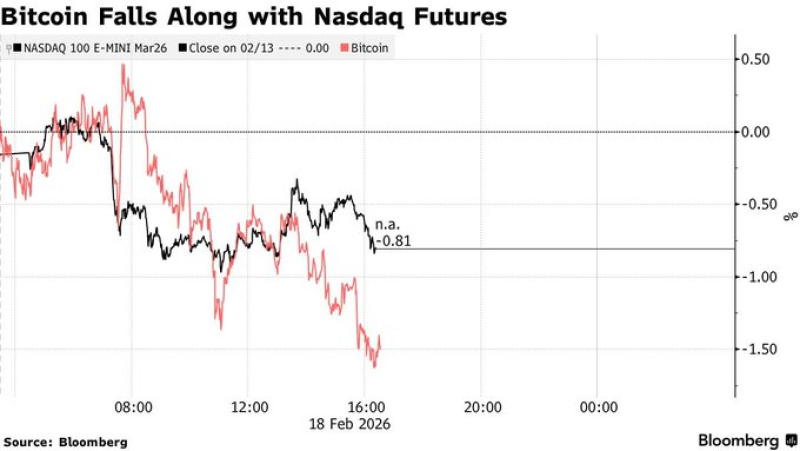

Bitcoin dropped 1.7% to around $67,600 ahead of the U.S. open, with Nasdaq 100 futures off 0.9% and S&P 500 contracts down 0.6%. The move was broad-based and deliberate — a classic risk-off rotation driven by Iran tensions, fresh inflation data, and growing doubt over whether the Fed will cut rates anytime soon. This is exactly the dynamic traders have flagged in recent weeks, as Bitcoin struggles at $67K as rally loses steam.

With geopolitics, inflation surprises, and Fed policy all in focus, Bitcoin's short-term price action may continue to mirror broader market stress.

ETF Outflows and Extreme Fear Point to Deeper Caution

The demand picture looks equally grim. U.S.-listed Bitcoin ETFs logged a fourth consecutive week of outflows — shedding $360 million in the last week alone. CryptoQuant's Fear and Greed Index hit 10, firmly in "extreme fear" territory.

Analysts now see $60,000 as the key support level to watch, with some warning that additional macro shocks could drag prices back toward the $50Ks — a scenario that's no longer theoretical, given that Standard Chartered slashes BTC target to $100K, warns of $50K risk.

Despite the near-term gloom, not everyone is bearish. Bitcoin (BTC) poised for "great bull market" despite recent dip — a reminder that macro headwinds rarely write the whole story for crypto. For now though, until the Fed provides clearer guidance and geopolitical risk fades, Bitcoin's price is likely to keep trading as a risk asset first, and a store of value second.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah