The U.S. ETF market is experiencing an extraordinary surge in capital allocation. With $245 billion pouring into funds during the opening weeks of 2026, investors are demonstrating record-level risk appetite that exceeds even the speculative peaks of previous bull markets. This historic flow pattern raises important questions about market positioning, liquidity conditions, and what it means for widely-held vehicles like SPY.

Record ETF Inflows Signal Strong Risk Appetite in 2026

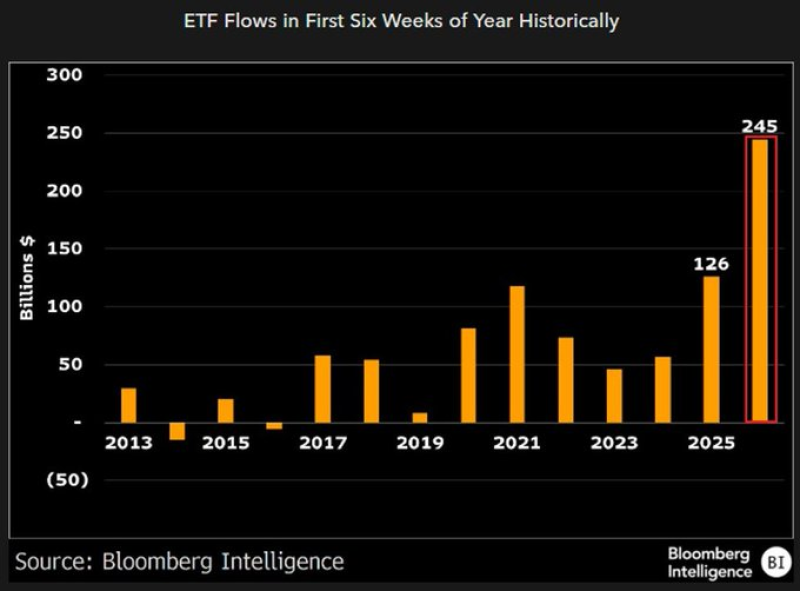

U.S. ETF inflows reached an unprecedented $245 billion during the first six weeks of 2026, according to data shared by The Kobeissi Letter. The figure represents a 94% increase compared to the same period in 2025 and marks the second straight year of rising early-year allocations. Even more striking, the total reflects a 346% jump since 2024 and more than doubles the inflows recorded in early 2021, a period widely associated with heightened speculative activity.

The number of ETFs with over $100 million in inflows exceeded 500 for the first time in this period of the year.

Historical data from Bloomberg Intelligence shows just how unusual this start has been. The first six weeks of 2025 brought roughly $126 billion in inflows, while most years over the past decade registered significantly smaller totals. The 2026 bar stands alone as the largest on record, pointing to a sharp acceleration in fund demand across the broader ETF ecosystem.

Broad Participation Across ETF Products

Breadth was another defining feature of the surge. More than 500 ETFs recorded inflows exceeding $100 million, marking the first time this threshold was reached during this early window of the year. The data suggests widespread participation rather than concentration in a handful of mega-cap or thematic products. While the report doesn't break down which segments led the charge, the scale points to strong demand for diversified exposure across multiple strategies and asset classes.

What Record Inflows Mean for Market Dynamics

A record start for ETF inflows is closely watched as a barometer of risk appetite and liquidity conditions. If this pace continues, it could reinforce trend-following behavior, influence positioning dynamics, and reshape how capital flows across sectors throughout 2026. At the same time, it raises sensitivity to any shift in macro expectations or policy changes that could reverse sentiment.

The U.S. equity ETF market has been on a tear, and the early 2026 data suggests that momentum is far from fading. Whether this surge reflects structural shifts in investor behavior or short-term positioning ahead of volatility remains a key question as the year unfolds. For now, the record inflows paint a picture of aggressive capital deployment and elevated market confidence.

Usman Salis

Usman Salis

Usman Salis

Usman Salis