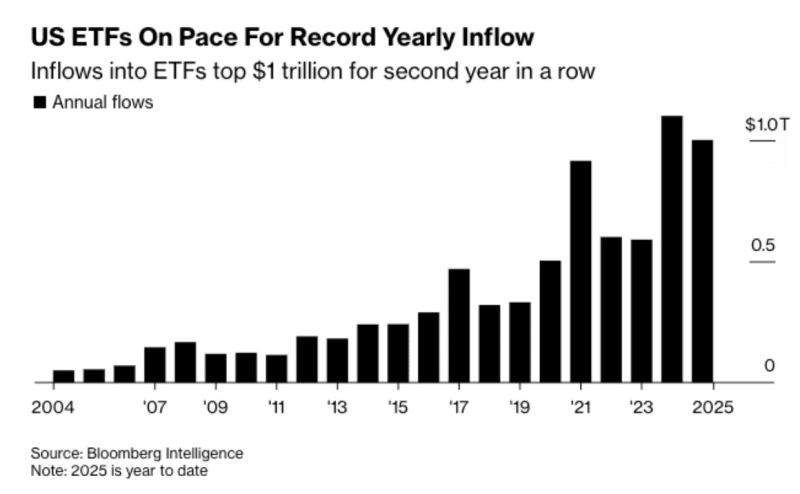

● Stock Sharks recently shared that U.S. ETFs are heading toward a record $1.25 trillion in inflows for 2025, making it the strongest year ever for these investment vehicles. Bloomberg Intelligence data shows ETF inflows have crossed the $1 trillion mark for the second year running, signaling a major shift toward passive investing among both institutions and everyday investors.

● This massive surge raises important questions about market structure. With so much money pouring into passive funds, some analysts worry about potential side effects: markets might struggle with price discovery, and we could see bigger swings during sell-offs. Critics point out that when everyone's money flows through index-tracking funds and algorithms, liquidity can dry up fast if investors suddenly want out — creating a mismatch that could amplify downturns.

● The financial ripple effects are significant too. Low-cost ETFs have squeezed profit margins for traditional active fund managers, sparking discussions about tax policy in an industry increasingly run on automation and scale. Some experts suggest tweaking profit taxes for large financial players rather than hitting investors with broader capital gains changes — keeping these efficient tools accessible while balancing the books.

● Looking at the bigger picture, ETFs have completely reshaped U.S. capital markets over the past decade. Total ETF assets now top $8 trillion, changing how money gets invested, how funds trade, and how portfolios are built worldwide. The appeal is clear: rock-bottom fees, easy trading, and flexibility across everything from stocks and bonds to commodities and niche themes.

Usman Salis

Usman Salis

Usman Salis

Usman Salis