XRP just did the unthinkable – it's now trading more than Ethereum on Coinbase. This could spark a major price rally for Ripple's token.

XRP Price Dominance: Crushing ETH Trading Volume

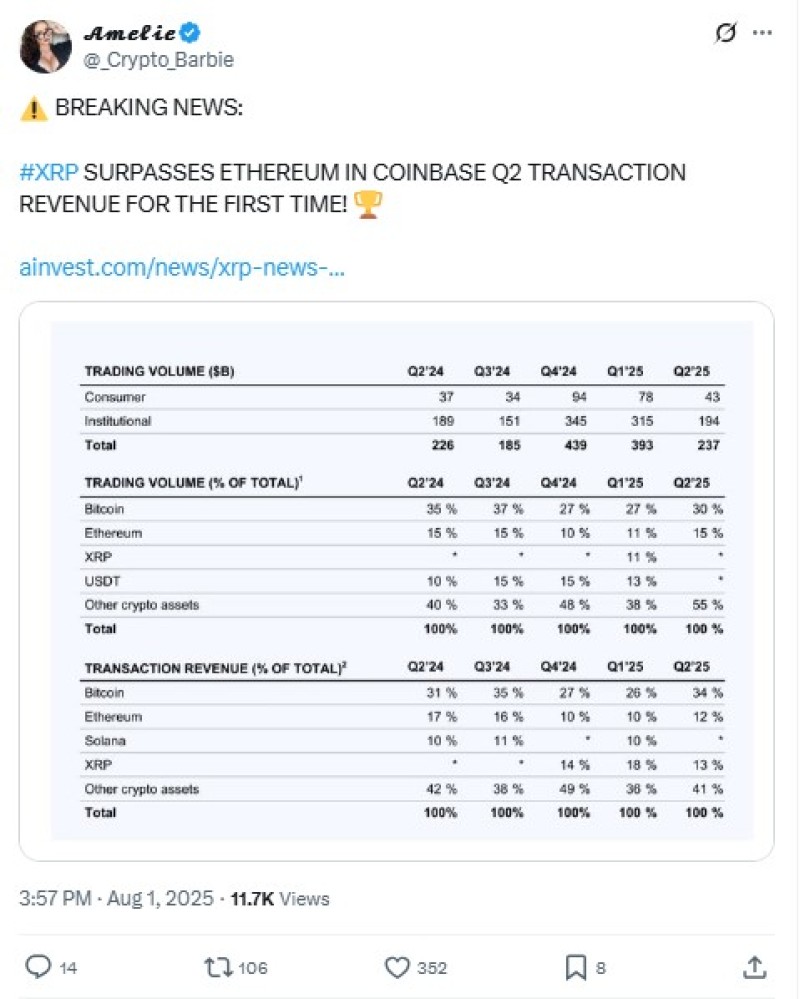

XRP grabbed 16% of Coinbase's trading revenue in H1 2025, while Ethereum only managed 15%. That's according to the exchange's latest SEC filing, and it's huge considering XRP was delisted in 2021 during the SEC lawsuit.

After the 2023 court ruling that XRP isn't a security when traded on exchanges, the token came roaring back. Q2 numbers show XRP maintained its lead with 13% of revenue versus ETH's 12%.

Ryan Rasmussen from Bitwise nailed it: "Wow, XRP trading accounted for more of Coinbase's trading revenue this year than ETH. Last year XRP wasn't even broken out."

XRP Price Catalysts: Derivatives Driving Demand

Coinbase is doubling down with new products. They became the first US-regulated exchange offering 24/7 trading for BTC, ETH, SOL, and XRP. Weekend volumes now match weekdays.

The big move? Coinbase Institutional launches nano Ripple perpetual futures on August 18. This gives US traders leveraged XRP exposure through a regulated platform, potentially bringing in institutional money.

XRP Price Technical: Stuck Below $3.10 Resistance

Despite the fundamentals, XRP's chart shows resistance at $3.10 and the 50-day MA at $3.12. Recent action around $2.95-$3.00 shows indecision, with RSI at 37 suggesting bearish pressure remains.

Key levels:

- Support: $2.89, $2.78, $2.67

- Resistance: $3.10, $3.31, $3.45

Trade setup: XRP at $2.96. Rejection at $3.04 = short to $2.89/$2.78, stop above $3.12. Clean break above trendline = bullish breakout.

The fundamentals are screaming buy, but technicals need to catch up. If XRP breaks $3.12, this Coinbase story could ignite something much bigger.

Peter Smith

Peter Smith

Peter Smith

Peter Smith