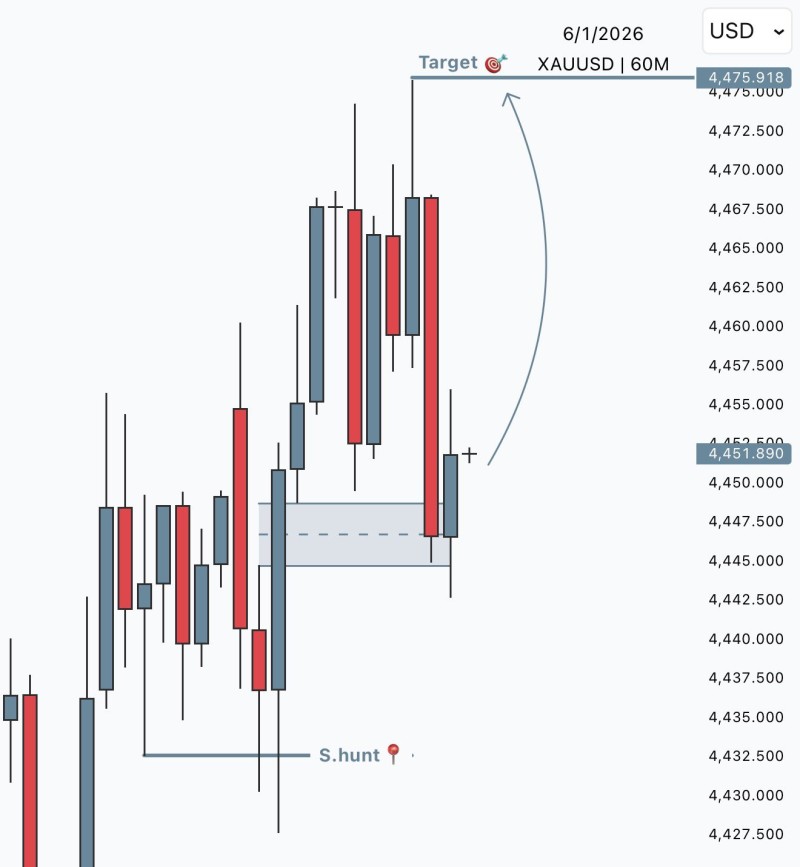

⬤ Gold (XAU/USD) staged a recovery after dropping sharply on the 1-hour timeframe, bouncing from a key liquidity zone and climbing back toward the mid-$4,450s. The recent price action showed a classic sell-side liquidity sweep—where price dipped below recent lows to trigger stops—before reversing hard to the upside. This kind of move often signals a shift in order flow, and gold quickly recovered to around $4,451.89 after briefly testing support.

⬤ The dip below recent lows was interpreted as a "stophunt," clearing out weak hands before the market reversed direction. Strong bullish candles followed, confirming what traders call a structural reaction. Price moved back into a discount zone—the shaded area on the chart where buyers were waiting to step in. From there, the structure favors continuation toward a premium target near $4,476.

⬤ As long as gold stays supported above the reclaimed short-term zone, the path of least resistance appears to be higher. The setup relies on institutional-style concepts like liquidity sweeps, displacement, and order block interaction—basically, the idea that price hunts liquidity before making its real move. The target sits at the recent upper resistance zone, with the projected path curving upward if conditions hold.

⬤ This technical setup matters because gold continues to react strongly to short-term liquidity grabs around intraday levels. A sustained hold above the rebalanced zone supports expectations for another push higher, while a break back below the swept range would weaken the bullish case. Trading in the mid-$4,400s with elevated volatility, gold is now at a decision point—either build on this rebound toward $4,476, or lose momentum before reaching that threshold.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets