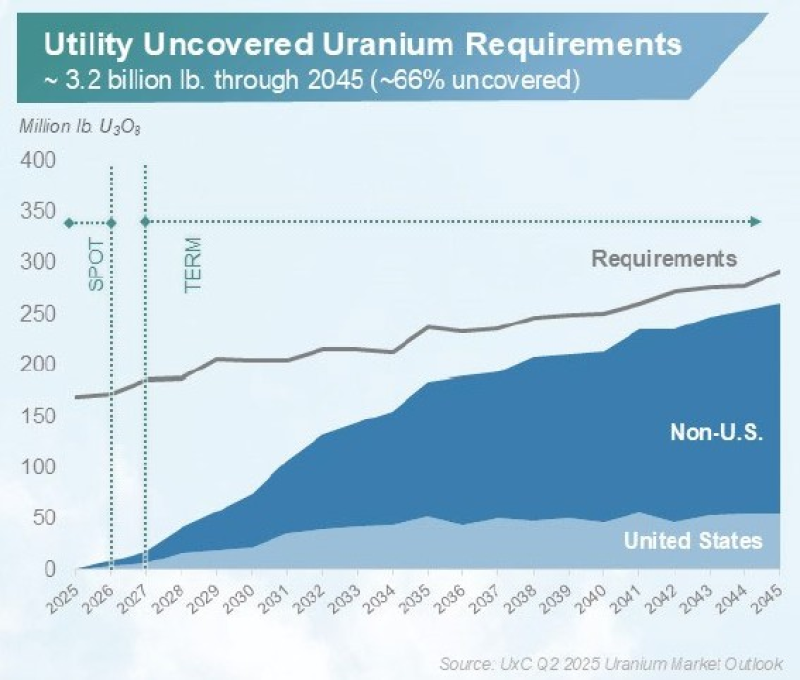

⬤ A long-term projection of uranium contracting levels reveals a massive supply coverage gap for nuclear utilities. Utilities have largely stayed on the sidelines in recent years, leaving a huge chunk of future fuel requirements unsecured for the decades ahead.

⬤ The chart labeled "Utility Uncovered Uranium Requirements" shows roughly 3.2 billion pounds of U3O8 demand stretching through 2045—with about 66% currently uncovered. Requirements are climbing steadily over time, while secured volumes remain relatively flat. The visualization breaks down United States versus non-U.S. demand, highlighting that a substantial portion of the uncovered requirements sits outside American borders.

⬤ What's interesting here is that nuclear fuel expenses represent only about 5% of utility operating costs—meaning even significant procurement price swings would barely dent overall operational spending.

⬤ The outlook underscores how contracting cycles shape long-term fuel availability. With such a large portion of projected demand still uncovered through 2045, future purchasing activity could significantly influence market coverage levels and supply planning across the nuclear fuel sector. The gap suggests utilities have been banking on spot market availability or betting that future supply will materialize when needed—a strategy that could face challenges if tight market conditions persist.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah