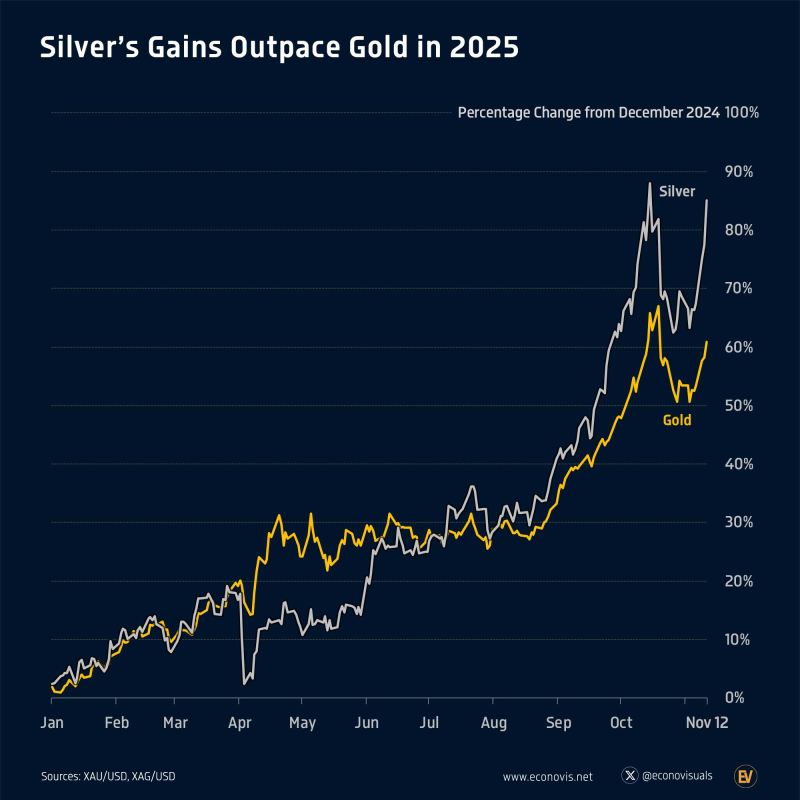

⬤ Silver's gains have dramatically outpaced gold in 2025, with spot prices surging 85% year-to-date by November 12, compared to gold's 61% rise. This marks silver's strongest performance in more than a decade. The metal began accelerating steadily throughout the year, breaking away from gold in late summer and early autumn as industrial demand picked up steam. This widening performance gap has put silver at the center of precious metals discussions, reflecting growing investor interest in assets that serve both industrial and monetary purposes.

⬤ As prices climb, proposed tax changes are introducing new uncertainty into the precious metals sector. Potential increases in capital-gains taxes on commodities, restrictions on mining R&D deductions, and stricter compliance requirements for bullion-backed financial products could raise costs across the board. Smaller mining operations with tight profit margins face the greatest risk—additional tax burdens could threaten their survival. Higher taxation on specialized geological, engineering, and metallurgical expertise may also trigger an exodus of talent just when producers are trying to scale up operations. These regulatory headwinds stand in stark contrast to the current bullish momentum, creating a complicated outlook for metals markets heading into 2026.

⬤ Silver's rally intensified through the final quarter of 2025, consistently outperforming gold and hitting multi-year highs. While gold continues its role as a hedge against inflation and geopolitical uncertainty, silver's industrial applications—particularly in solar panels, electronics, and battery manufacturing—have driven its exceptional performance. As policymakers weigh new tax frameworks and investors reconsider their commodities exposure, silver's remarkable advance stands as one of the most significant commodity market stories of 2025.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova