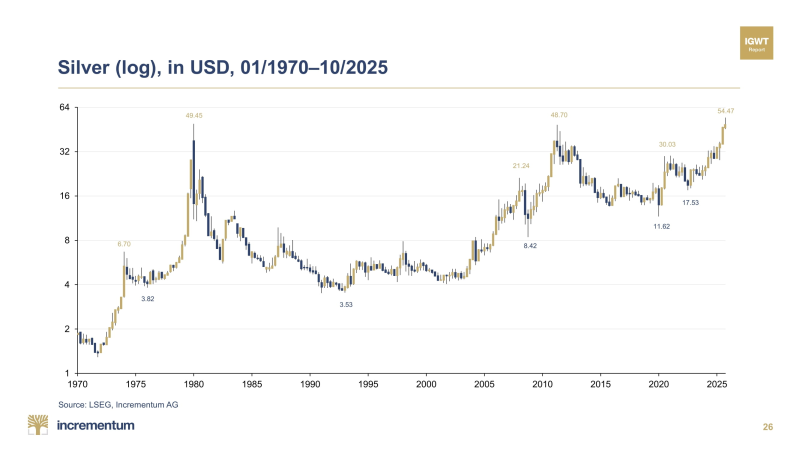

⬤ Silver's pushed into record territory for the first time in almost five decades, blowing past every previous peak in the books. The metal climbed to $54.24, leaving behind the old highs from 1980 at $49.45 and the 2011 spike that topped out at $48.70. Looking at the full price history from 1970 through 2025, this recent breakout sits above everything that came before it, marking a massive shift in the market.

⬤ The chart tells quite a story—showing lows around $3 to $4 back in the 1970s and 1990s, then the major spikes that got everyone's attention in 1980 and 2011. The latest surge hit around $54.47, lining up with the reported $54.24 close. Right after touching that peak, silver got hammered with a nearly 20 percent pullback that pushed it down into the mid-$40 range. But here's the thing—it's already bounced back and is now trading above $50 again, showing there's still plenty of strength left in this move.

Silver has set a new all-time high after nearly five decades, extending its remarkable upward run to fresh historic territory.

⬤ Looking back over the decades, silver's had these long stretches where not much happens, followed by explosive moves higher during big economic shifts. The recent run took silver way past earlier resistance levels like $21.24 from 2008, $30.03 in 2020, and $17.53 from the early 2020s. This push into late 2025 represents one of the most powerful multi-year rallies in modern trading history. The new all-time high isn't just a number—it's a major psychological and technical breakthrough that could change how traders and investors think about precious metals.

⬤ Why does this matter? When silver breaks through major long-term resistance like this, it tends to shift sentiment across the entire precious-metals space. Momentum picks up, macro conditions come into play, and suddenly everyone's talking about hard assets again. The fact that it bounced back above $50 so quickly after that steep drop really shows how strong the underlying demand is right now. This isn't just a flash in the pan—it's reflecting a period where people are seriously piling into hard assets, and that's driving real price action in the market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah