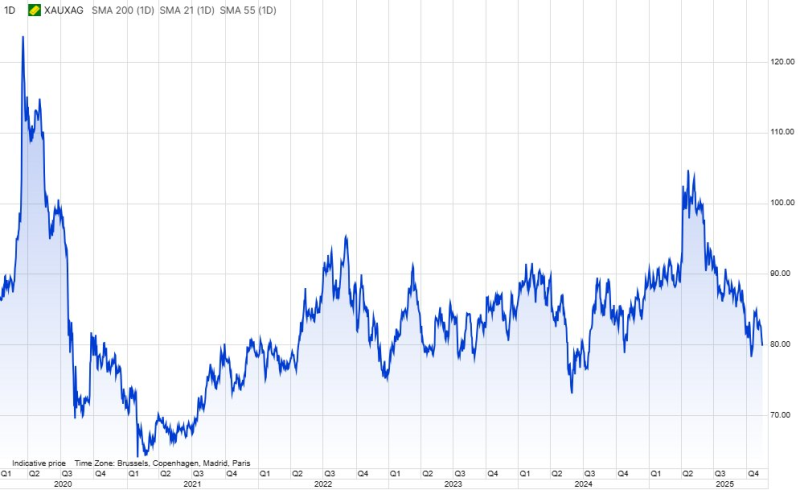

⬤ The gold–silver ratio has slipped below 80 ounces of silver per ounce of gold for the first time in three weeks. This shift signals a fresh wave of silver outperformance as precious metals bounce back from their recent pullback.

⬤ The XAU/XAG ratio has pulled back from levels above 82, showing a change in market dynamics. When this ratio falls, it typically means silver is gaining faster than gold—usually during periods of better investor sentiment or stronger industrial demand. Silver's higher volatility makes it a natural leader during bullish phases in the metals market.

⬤ While silver's rally could extend if the metals rebound holds, volatility remains a significant risk. Historical averages tell an interesting story: the 5- and 10-year averages sit around 82, but the 25-year average is closer to 70. This suggests silver may have more upside potential if the long-term trend continues. Future strength will likely hinge on factors like the U.S. dollar, real interest rates, and ETF flows.

⬤ The current pattern reinforces silver's dual role as both an industrial metal and a leveraged bet on gold's recovery. If momentum continues, silver could maintain its outperformance in the near term.

Peter Smith

Peter Smith

Peter Smith

Peter Smith