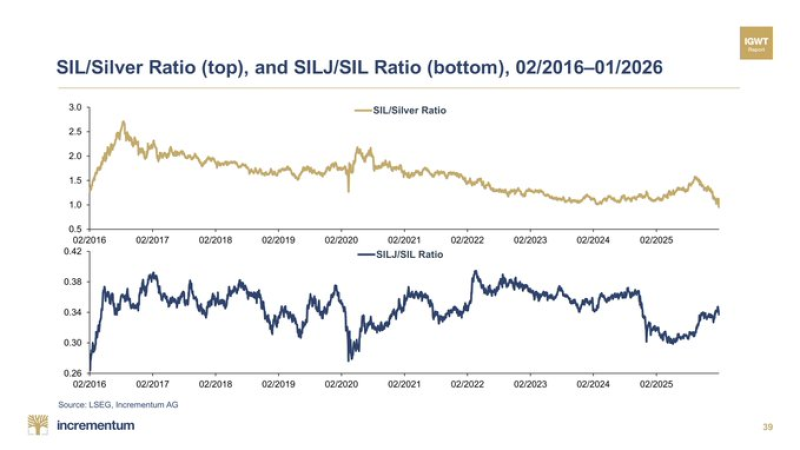

⬤ Silver (XAG) has kicked off 2026 with clear relative strength over listed silver miners. The SIL/Silver ratio has continued sliding into early 2026 and is now sitting at its lowest level in 10 years - a straightforward signal that the metal itself is outrunning the equity basket tied to silver producers, even though mining stocks are supposed to offer leverage to moves in the underlying commodity.

⬤ Charts covering February 2016 through January 2026 track two ratios side by side. The top panel shows the SIL/Silver reading sliding to a decade low, confirming that the Global X Silver Miners ETF has consistently underperformed the physical metal over this stretch. In theory, miners amplify silver's moves - in practice, right now, the metal is doing the heavy lifting on its own.

⬤ The lower panel tells a similar story for junior miners. The SILJ/SIL ratio is described as "only grinding back toward long-term averages," meaning junior silver miners haven't managed a decisive breakout versus larger producers. That matters because juniors typically lead the charge during the higher-beta, risk-on phases of a metals upcycle. The fact that they haven't done so yet suggests momentum is still anchored in Silver (XAG) rather than the riskier end of the mining complex.

⬤ Put it all together and the picture for early 2026 is fairly clear: Silver is setting the pace while miners, especially the junior names, are still working to catch up. The decade-low SIL/Silver reading highlights an unusually wide gap between metal and miner performance. The sluggish normalization in SILJ/SIL adds to that picture, pointing to ongoing caution in the riskiest corners of the silver trade. For anyone watching precious-metals momentum, these relative moves are worth tracking - they tend to reflect where real risk appetite is building and where it's still sitting on the fence.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi