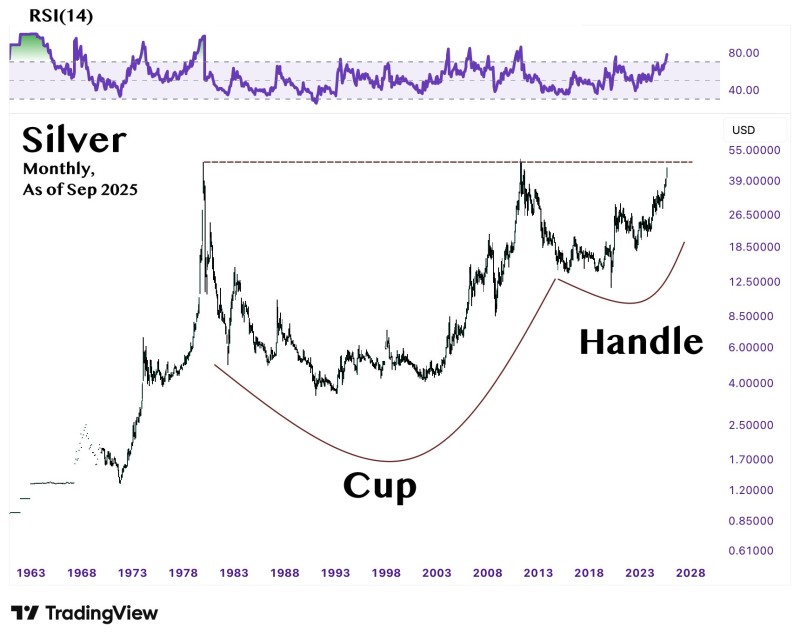

Silver has always been one of the most volatile and closely watched commodities in financial markets. After decades of dramatic price swings, the precious metal is once again approaching levels not seen since the Hunt brothers' manipulation in 1980 and the commodity boom of 2011. What makes this moment particularly compelling is the emergence of what appears to be one of the most significant technical patterns in silver's modern history: a 45-year cup-and-handle formation that may finally be nearing completion.

The Technical Setup Takes Shape

Famous analyst Tuncer Şengöz notes that this massive pattern tells the story of silver's long journey through boom, bust, and consolidation.

The cup formation began with silver's dramatic spike near $50 in 1980, followed by a multi-decade decline that bottomed around $4 in the late 1990s. The subsequent recovery, which peaked again near $50 in 2011, completed what technical analysts call the "cup" portion of this rare pattern.

Since 2011, silver has spent over a decade in what appears to be the "handle" phase, consolidating mostly between $12 and $30. This extended sideways action has frustrated many investors, but it may have been necessary to build the foundation for what could be silver's next major move. The critical resistance zone now sits between $50 and $55, representing the breakout level that would complete this historic formation.

Momentum Indicators Support the Move

The monthly RSI shows rising momentum without reaching extreme overbought levels, suggesting there's still room for further upside if the breakout materializes. This technical strength, combined with the sheer scale of the pattern, creates a compelling setup for those watching precious metals markets.

Multiple Catalysts Align

Several factors are converging to support silver's potential breakout. The current macro environment features persistent inflationary pressures and geopolitical tensions that typically favor precious metals. Central banks worldwide continue their aggressive gold and silver accumulation, providing institutional support for the sector.

On the industrial side, silver's role in renewable energy technology, particularly solar panels and electric vehicle components, continues to grow. This creates structural demand that didn't exist during previous silver rallies, potentially providing a more sustainable foundation for higher prices.

The Path Forward

If silver manages a convincing break above $55, the cup-and-handle pattern suggests potential targets in the $80-$100 range over the coming years. However, failure to break through this crucial resistance could result in another extended consolidation phase, keeping silver range-bound between $20-$40 while the pattern continues to develop.

The stakes are particularly high because patterns of this magnitude and duration are exceptionally rare in commodity markets. A successful breakout wouldn't just signal another cyclical rally - it could mark the beginning of a new secular trend that redefines silver's role in global markets for decades to come.

Peter Smith

Peter Smith

Peter Smith

Peter Smith