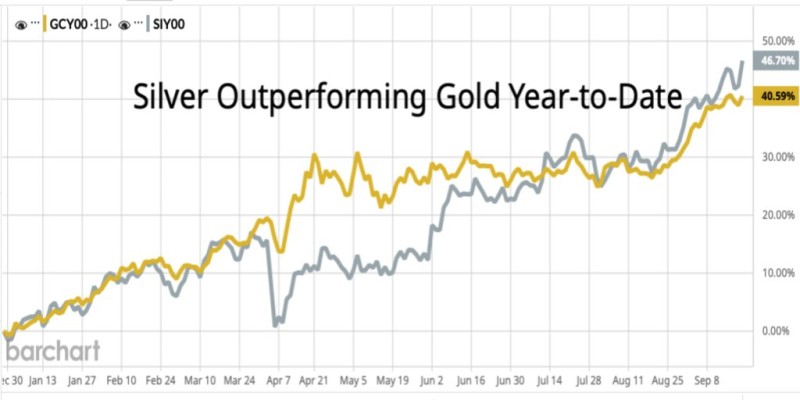

Silver (XAG) is commanding attention in 2025's remarkable precious metals rally. While gold has posted impressive gains of 40.6% year-to-date, silver has surged nearly 47%, breaking free from its traditional correlation with gold. The gold-to-silver ratio has dropped below 86, a crucial technical threshold that reinforces expectations for silver's continued strength through year-end.

Silver vs Gold Performance: Chart Analysis

The performance chart reveals the diverging paths of these two precious metals. Both have rallied powerfully this year, but silver began accelerating past gold during late summer. This steeper ascent reflects growing investor appetite for the white metal. Analyst James Turk notes that the gold-to-silver ratio, currently hovering near 85.5, has broken critical support levels.

Should the ratio continue declining toward 80, silver's relative outperformance could expand significantly.

Driving Forces Behind Silver's Superior Performance

Several factors are fueling silver's stronger rally compared to gold. Industrial demand remains a key differentiator, as silver's essential role in solar panels, electronics, and clean energy technologies positions it to benefit from the global green technology boom. From a technical perspective, silver is approaching the psychologically important $50 level - a 25-year ceiling that, if breached, would signal the beginning of a fresh long-term bull market. Additionally, monetary conditions favor both metals, but silver's inherent volatility amplifies gains when speculative capital flows return to precious metals.

Gold Remains Strong Despite Silver's Lead

Gold maintains its resilience, recently trading at $3,685.50 and targeting the $4,000 milestone. The yellow metal continues benefiting from central bank accumulation and its enduring safe-haven status. However, despite these fundamental strengths, gold has been overshadowed by silver's more dynamic performance this year.

Silver Price Target: The $50 Breakout

If silver sustains its current momentum, breaking above $50 becomes the critical test. Successfully surpassing this level would end decades of range-bound trading and potentially ignite a new secular bull market. Should momentum weaken, silver might pull back toward $40, but as long as the gold-to-silver ratio continues declining, the overall uptrend remains firmly intact.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah