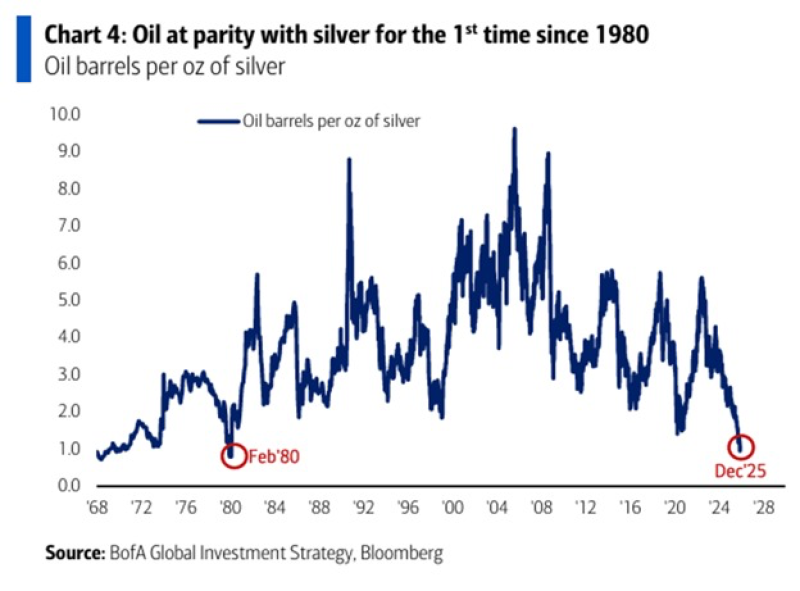

⬤ Silver has reached the same price as oil for the first time since the early 1980s. One ounce of silver now trades at $63.80, which is $6.50 above a barrel of WTI crude at $57.30. The oil-to-silver ratio has returned to the level last observed in February 1980, an event that seldom occurs in commodity markets.

⬤ The shift has been sharp. In mid-2022 during the supply shortage and inflation surge, oil cost about 5.5 times the price of silver. From that point silver has surged 206 percent while oil has dropped 44 percent erasing the gap step by step.

The oil-to-silver ratio falling back to 1980 levels underscores the historical nature of this move.

⬤ This year's figures spell out the change. Oil has lost roughly 20 percent and is on course for its poorest annual result since the 2020 pandemic collapse. Silver has gained 115 percent, its largest yearly rise since 1979.

⬤ The ratio matters because analysts have long treated it as a gauge of commodity market health. Its return to parity after four decades reveals how far conditions have swung - feeble oil prices have collided with a forceful silver advance. The alignment highlights the extent of the moves in both markets.

Usman Salis

Usman Salis

Usman Salis

Usman Salis