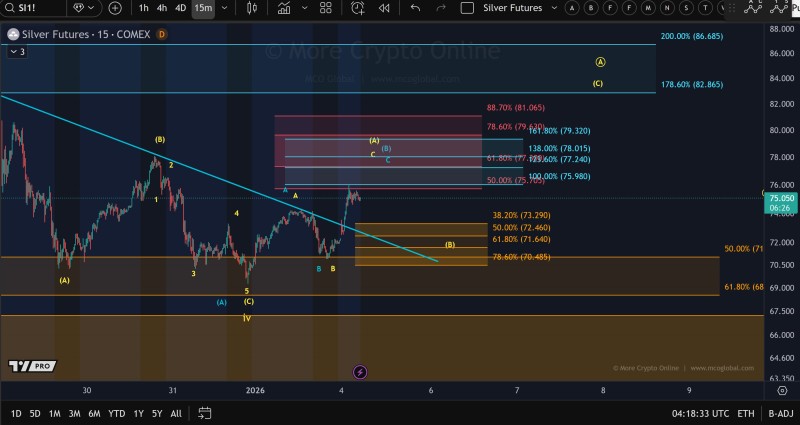

⬤ Silver is moving through a corrective pattern on the short-term chart, with fresh technical analysis revealing updated micro support levels for wave (B). The metal continues consolidating around $75.05 on COMEX futures, with Elliott Wave structure mapping both the recent rally into wave (A) and the current pullback into wave (B).

⬤ Four key retracement support levels have been identified in the orange zone: 38.2% at $73.29, 50% at $72.46, 61.8% at $71.64, and a deeper 78.6% level near $70.49. Price has already broken through a descending trendline and is now holding just above the lower support band. Upside Fibonacci projections from the previous advance show potential targets at $75.98 (100%), $78.01 (138%), and $79.32 (161.8%), with extended wave (C) targets marked near $82.87 and $86.69.

⬤ Traders are watching whether Silver will dip further into the support box before reversing higher, or if consolidation will continue sideways above current levels. Internal sub-wave labeling tracks the correction's progression from late December through early 2026.

⬤ This analysis matters because Silver has seen volatile price swings recently, and having clear support references helps traders navigate corrective phases. With the metal hovering near $75 while multiple support levels sit below, market participants are monitoring how price responds around these retracement zones as wave (B) unfolds.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir