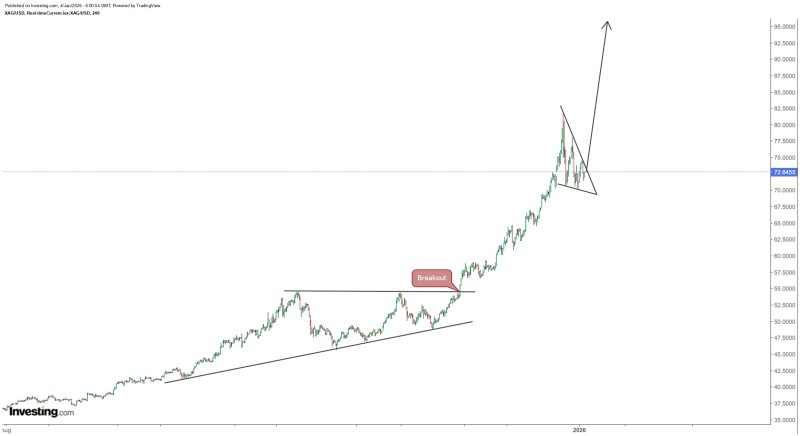

⬤ Silver has been on an absolute tear lately, rocketing higher through late 2025 before hitting the brakes. The white metal jumped roughly 50% in a single month following a technical trigger on November 28, 2025, and now sits near the point of a bullish wedge formation around the $72.85 mark. Price action has been squeezing tighter as buyers and sellers duke it out within this narrowing pattern.

⬤ Looking at the chart, silver's climb from much lower levels shows a clear breakout zone that kicked off this acceleration phase. After that initial push, the metal kept grinding higher until forming the current wedge—basically a triangle where the price is making higher lows and lower highs between roughly $70 and $75. What's catching eyes is the projection arrow pointing north, suggesting the rally could resume with force. Some analysts are even floating a $96 target that might arrive faster than anyone initially thought.

⬤ That 50% monthly gain is massive by any standard, and it's why this consolidation matters so much. Even though silver is taking a breather right now, the bigger picture still shows a strong uptrend firmly in place. The metal is essentially coiling near the top of its recent run, and the smart money is watching closely to see which way it breaks when the wedge resolves early next week.

⬤ This isn't just chart-watching for its own sake—silver moves like this ripple across markets. As both an industrial metal and a precious metal safe haven, big swings in silver tend to grab attention from commodity traders, macro investors, and even retail buyers. How this wedge plays out could set the tone for the entire precious metals complex in the coming weeks.

Usman Salis

Usman Salis

Usman Salis

Usman Salis