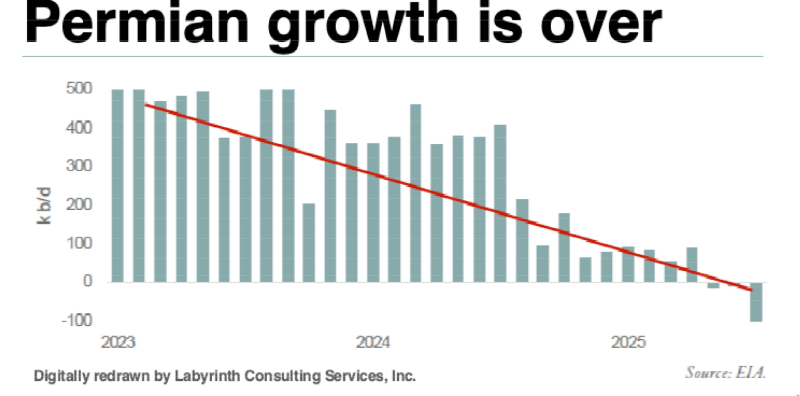

⬤ The Permian Basin oil boom is running out of steam. Monthly production increases that hit 450,000 to 500,000 barrels per day back in 2023 have now crashed to zero and gone negative in 2025. This isn't a temporary blip—it's a fundamental shift in America's biggest oil-producing region.

⬤ U.S. Energy Information Administration data shows the decline is persistent and accelerating. Production gains kept shrinking throughout 2024, and by 2025 the numbers turned red. The Permian used to be the go-to solution whenever global oil markets needed more supply. That safety net is disappearing.

⬤ The market is starting to rethink what oil actually represents. As one analyst put it: "Oil isn't gold yet, but when financial carry dynamics weaken, capital moves away from crowded paper exposures toward under-owned physical necessities." Oil and gas are being reframed—not just as energy commodities tied to demand, but as physical assets that hedge against supply shocks and systemic risks.

⬤ Here's why this matters: for years, traders and policymakers assumed U.S. shale could quickly ramp up whenever prices spiked. If the Permian can't deliver that flexibility anymore, oil markets become way more vulnerable to supply disruptions. Prices could swing harder, and the strategic calculation around energy security completely changes. Oil is shifting from a flexible supply source to a supply-constrained asset that might need to be treated more like insurance than fuel.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah