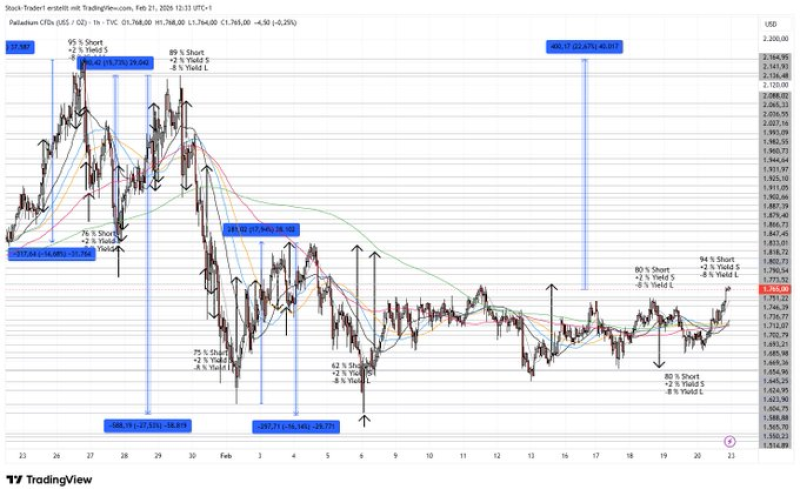

⬤ Palladium caught traders off guard with a roughly 5% surge, even as positioning sits at an extreme. A staggering 94% of market participants are currently short XPD. That kind of one-sided crowding rarely ends quietly. Historical annotations on the referenced chart show palladium making sharp, fast moves every time positioning reached similar extremes - and right now, price is climbing while the short side stays packed.

⬤ The chart's pattern is hard to ignore. Each prior episode where shorts dominated and price moved against them triggered abrupt reactions around key resistance levels and moving averages. The current setup mirrors those moments: XPD palladium bouncing off support while 94% of the market bets on further downside is exactly the kind of tension that can accelerate volatility quickly. If shorts are forced to cover, even partially, the intraday swings could get ugly fast.

⬤ That quote says a lot. This isn't a macro call - it's pure tactical survival. The author isn't predicting a new bull run in palladium; they're managing risk in real time against a market moving the wrong way for 94% of participants. Palladium already showed it can bounce hard at key technical levels like the 50 EMA, and leveraged short positions in that kind of environment can unwind in minutes, not hours.

⬤ The next few sessions will tell the story. If XPD keeps grinding higher, the positioning imbalance almost guarantees elevated volatility - shorts under pressure tend to push price faster than any fundamental headline could. On the flip side, a stall near resistance would bring relief to bears and likely trigger the kind of reversal the chart has shown before. Either way, palladium near key structure levels with extreme short positioning is not a market to sleep on right now.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah