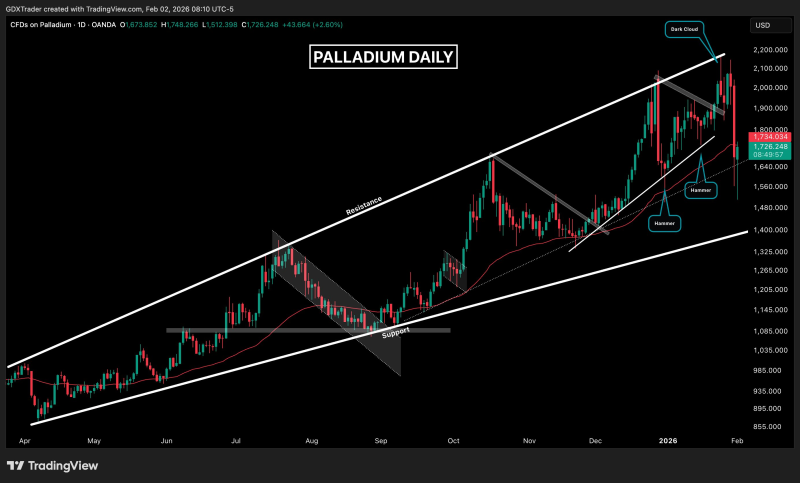

⬤ Palladium prices bounced aggressively intraday, carving out a hammer candle just under the 50 exponential moving average on the daily timeframe. Sellers dominated early, extending the prior session's losses and briefly pushing prices to fresh short-term lows. But buying pressure came roaring back, rejecting those lows and stabilizing the market before the close.

⬤ The chart reveals palladium trading inside a broader ascending structure, bouncing between rising support and resistance zones. That hammer candle shows a clear momentum flip—downside pressure evaporated and buyers absorbed everything sellers threw at them near the lows. This kind of action typically signals seller exhaustion, especially after a sharp drop and right at a key moving average like the 50 EMA.

⬤ The bigger trend is still pointing up, marked by higher highs and higher lows inside an ascending channel. The recent pullback came after price got rejected near the top of that structure with a dark cloud-style candle near the highs. If the next session closes higher, it confirms the hammer as a potential pivot low. Breaking back above the 50 EMA would strengthen the case that this was just a correction, not the start of something deeper.

⬤ This matters because palladium's been volatile lately, making clear demand signals critical for what happens next. A confirmed reversal here could put the broader uptrend back on track. But if buyers don't follow through, corrective pressure stays in play. How palladium handles these technical levels over the next few sessions will tell us whether the rally continues or the consolidation drags on.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi