The energy sector is entering a repricing phase that's catching many traders off guard. While headlines focus on price swings, the real story lies in how fundamentally the market is reshaping itself. Oil and gas aren't collapsing—they're recalibrating around new realities that could define trading strategies for years to come.

Market Forces Driving the Energy Repricing

Oil and gas markets are going through a major repricing as multiple forces hit simultaneously. Geopolitics, policy shifts, and macro growth are all pulling prices in different directions at once. This isn't your typical boom-bust cycle—it's what traders are calling a "volatility year" where expectations get reset almost weekly.

The demand picture has actually gotten stronger, not weaker. Energy transition plans are hitting roadblocks, which means fossil fuels aren't getting replaced as fast as predicted. Consumption stays sticky while security concerns keep hydrocarbons front and center. That's why prices hold up even when instability hits—the market's adjusting, not breaking down.

LNG Supply Glut Meets Crude Oil Pressure at $60-70 Range

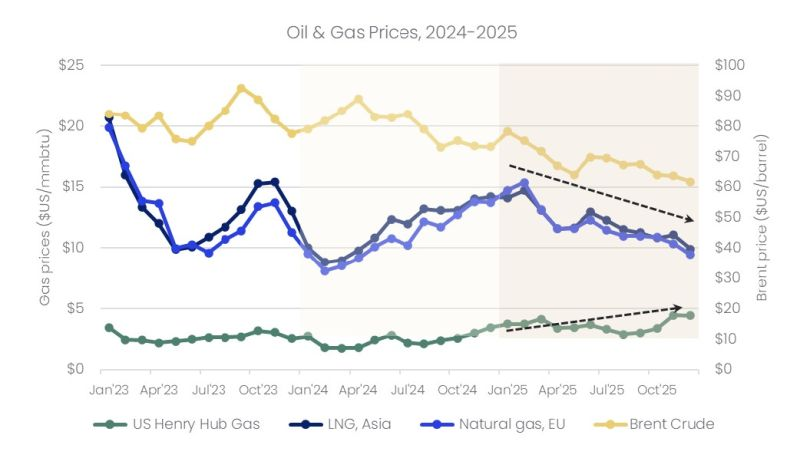

Near-term oversupply is hitting crude and LNG hardest. New LNG capacity is flooding the market, pushing global prices toward convergence and squeezing margins everywhere. Henry Hub is climbing while global gas benchmarks drop, and Brent crude drifts toward the $60-70 range—showing how unevenly pressure is distributed across different fuels. Similar patterns appeared in discussions about oil supply pressure, natural gas volatility, and the broader energy sector cycle.

What This Means for Energy Traders

The bigger picture is strategic, not cyclical. Upstream assets matter again. Capital discipline stays tight. Automation and AI are moving from pilot programs into real operations. Oil and gas prices aren't breaking—they're repricing around security, scale, and demand that won't disappear overnight. The next phase won't be about stability. It'll be about positioning before everyone else figures out where the market's actually headed.

Usman Salis

Usman Salis

Usman Salis

Usman Salis