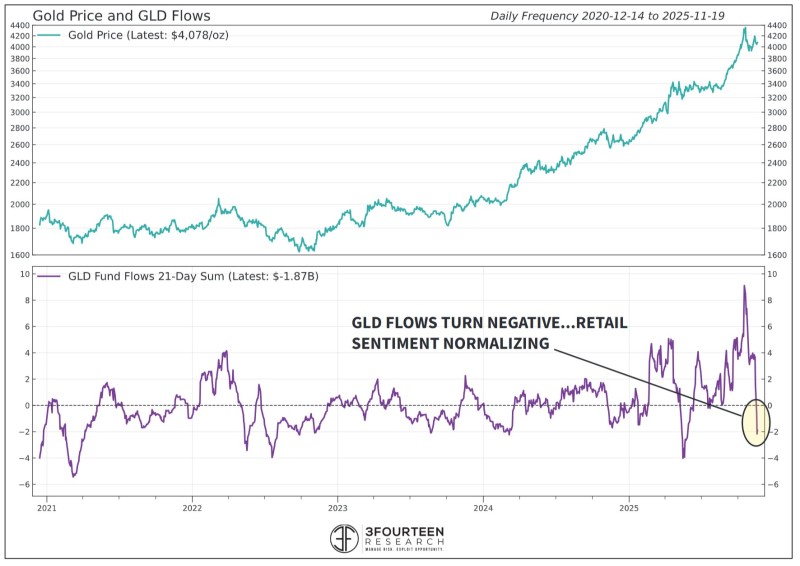

⬤ The chart highlights gold's multi-year climb from the $1,700-$1,800 range in late 2020 and 2021 toward recent highs above $4,200. Despite this strong long-term rally, GLD flows have broken below zero, showing that short-term sentiment has become more cautious. The data notes that retail sentiment is "normalizing" as flows move into negative territory, which lines up with gold's pullback from recent peaks.

⬤ The size of the current outflows stands out when compared to previous drawdowns. The GLD flow line has swung lower after extreme inflows earlier in 2025, suggesting that positioning has reset more aggressively than usual. This normalization in fund flows, combined with gold's modest correction, hints that the bottom of the current pullback may already be in place or getting close. The stabilization near the zero line in recent weeks suggests selling pressure might be easing.

⬤ This matters because GLD flows are a key indicator of retail sentiment and near-term demand for gold. When flows shift sharply from extremes back toward neutral levels, it often signals a move away from crowded positioning and helps calm volatility in the precious metals market. With gold still trading near historically high levels and GLD flows normalizing, these conditions could shape expectations for what comes next in 2026.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah