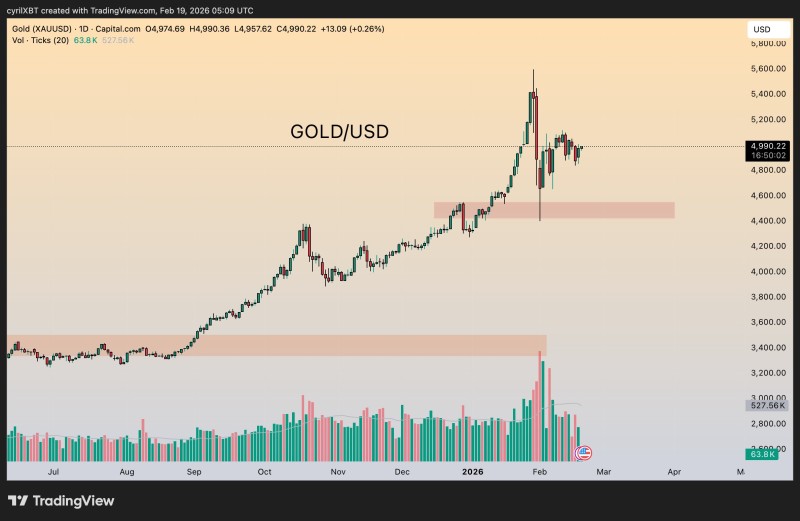

⬤ Gold (XAU/USD) is taking a breather after an impressive rally that pushed prices toward the $5,000 mark. The precious metal is now consolidating while staying well-supported near $4,500. The chart shows price action stabilizing above a key demand zone following the recent explosive move higher.

⬤ The rally carried gold significantly higher before settling into a sideways pattern around $4,900. As long as the metal stays above that $4,500 threshold, the uptrend remains healthy - this looks more like a natural pause than any kind of reversal. This defensive positioning makes sense given the macro uncertainty driving safe-haven demand, particularly with massive debt maturities looming.

⬤ Right now, gold is moving sideways inside this consolidation zone after that strong impulse higher. "Gold continues to hold above the $4,500 support zone while markets digest the recent move." The chart reflects gold doing what it does best - acting as a safe haven while riskier assets stay choppy. This behavior fits perfectly with broader inflation dynamics and monetary policy expectations that continue supporting the metal.

⬤ The big picture here is clear: gold's long-term trend stays bullish, we're just seeing some short-term cooling. The $4,500 level is the line in the sand - hold above it, and the uptrend stays intact. Break below, and we might see deeper consolidation. For now, though, buyers are defending that zone while traders reassess where markets head next amid ongoing economic uncertainty.

Usman Salis

Usman Salis

Usman Salis

Usman Salis