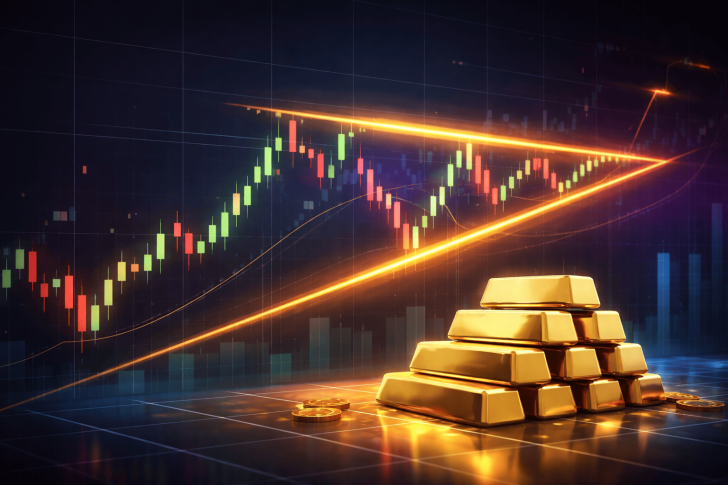

Gold markets are showing signs of stabilization following a period of sharp price movement. Despite the recent pullback, XAU/USD continues to trade within a well-defined technical pattern, suggesting the broader uptrend remains structurally sound. Market participants are closely watching key support levels as the precious metal consolidates.

Gold Finds Support at $4,900 Zone

Gold (XAU) is currently consolidating after experiencing a notable decline, with prices stabilizing near the $4,900 level. The metal has respected the lower boundary of an ascending broadening wedge pattern and bounced back from support.

The chart structure shows no breakdown of the broader upward formation, indicating that buyers stepped in at critical support levels. This price action suggests that gold's bullish structure remains intact despite short-term volatility.

Technical Pattern Shows Consolidation Phase

The current movement reflects consolidation rather than a trend reversal. After testing the wedge's lower support, gold has established a higher base within the structure, signaling price acceptance above recent lows. This behavior mirrors patterns seen in previous gold consolidation phases, where the metal paused before continuing its directional move.

Momentum has transitioned from rapid directional movement to range-bound behavior. Gold is now fluctuating between the wedge's expanding trendlines while maintaining higher lows, which keeps the broader trend framework intact.

Market Outlook and Key Levels

The broadening wedge pattern highlights a balancing phase following recent volatility rather than indicating a change in market direction. By remaining inside the wedge boundaries, gold preserves its bullish structure while the market establishes a foundation for its next significant move.

This consolidation phase allows the market to digest recent gains and build energy for potential continuation. Traders are monitoring whether gold can hold above the $4,900 support zone and eventually break toward the upper wedge boundary.

The technical setup suggests that while gold is taking a breather, the underlying bullish momentum hasn't been compromised. Market participants should watch for breakout signals from this pattern to determine the next directional move in precious metals markets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith