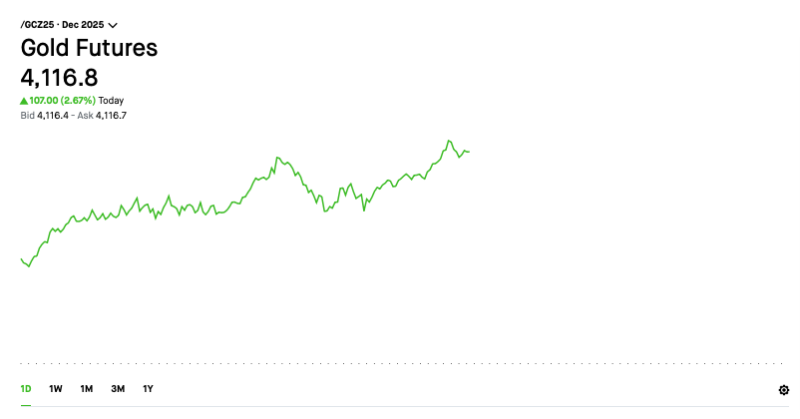

Gold blasted through the $4,000 mark today with serious force, showing that the metals market is heating up fast. December 2025 Gold Futures climbed past $4,116, racking up gains of over 2.6% and settling near fresh local highs. The move wasn't just a quick spike—it was backed by steady buying that kept pushing prices higher throughout the session.

Gold Futures (GCZ25) Push Higher Above $4,100

The intraday chart tells a clear story: gold's been climbing steadily all day, with buyers staying active and confident. After a strong mid-session push, prices stabilized comfortably above $4,100, showing no signs of backing down.

The upward slope is clean and consistent, with higher highs stacking up one after another. There's a consolidation zone forming near the top, which usually means buyers are catching their breath before potentially making another run. No major reversal patterns are showing up yet, and with bids holding firm without any heavy selling pressure, the trend looks solid.

What's Driving the Rally

Gold's getting a boost from several key factors right now. Geopolitical tensions are keeping investors nervous, pushing more money into safe-haven assets. There's also talk about softer U.S. economic data coming down the pipeline, which tends to make metals more attractive. Add in speculation about future rate cuts—historically a good thing for gold—and growing institutional interest in commodities, and you've got a recipe for continued strength. All these forces are lining up to support the metal's upward move.

Technical Outlook: Bulls Still in Control

Looking at the technicals, short-term support is holding near $4,050, while the next resistance zone sits somewhere between $4,150 and $4,200. The price structure suggests bulls might be gearing up for another leg higher soon. There's no exhaustion showing on the chart—instead, that shallow consolidation at the highs typically means the market's preparing for its next move up.

Key technical levels to watch:

- Support zone: $4,050 providing a cushion for any pullbacks

- Resistance target: $4,150–$4,200 range where sellers might show up

- Trend structure: Clean higher highs with sustained buying pressure

- Next potential target: Test of $4,200, possibly pushing toward new highs

Gold's sitting pretty above $4,100, backed by strong demand and favorable macro conditions. If this momentum keeps rolling, we could see a test of the $4,200 area before long, with the door open to new highs later this quarter. Right now, the metals market is clearly in growth mode, and sentiment is leaning heavily toward more upside ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis