Gold (XAU) prices are hitting a critical point as traders evaluate mounting signs of a potential downward shift. A recent technical analysis highlights several bearish scenarios developing across gold's price structure, with indicators suggesting a possible trend reversal if key support levels give way.

Chart Reveals Early Structural Weakness

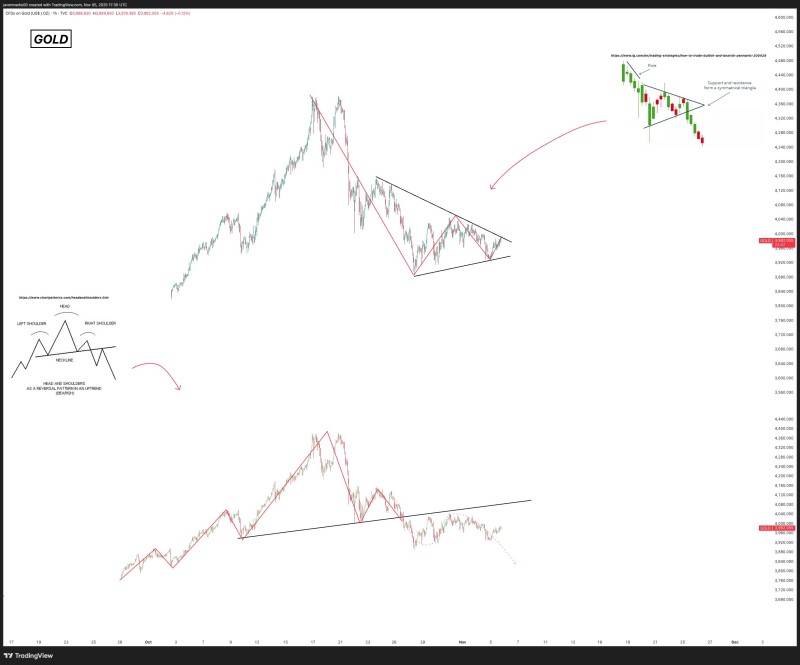

JAVON MARKS points to gold's multi-timeframe setup, which shows converging bearish formations. The metal appears to be forming a descending wedge pattern after an extended rally. These structures can lead to either continuation moves or downside breakouts when momentum weakens.

The chart's top-right section emphasizes this pressure, displaying a breakdown from a symmetrical triangle—a pattern typically linked to indecision that resolves in the direction of the prevailing short-term trend. Red candles confirm renewed selling pressure following this breakdown, supporting the bearish scenario theme.

Meanwhile, a head-and-shoulders formation suggests the potential for a deeper reversal phase. This classic pattern, featuring a peak flanked by two smaller highs, usually signals exhaustion in uptrends. The neckline breach visible in the smaller chart indicates sellers are taking control.

Critical Support and Resistance Levels

Gold is currently hovering near the lower edge of its wedge formation—a crucial support zone that, if broken, could trigger further declines. The chart points to several important levels: primary resistance sits around $4,300–$4,400 where the triangle breakdown started, immediate support near $4,000 aligns with the wedge's lower boundary, and a major downside target could extend toward $3,700–$3,800 if the head-and-shoulders neckline confirms. This pattern sequence shows growing technical vulnerability, marking a shift from the consolidation-driven optimism seen earlier this year.

Market Context and Fundamental Drivers

Technical signals lean bearish, but fundamental factors behind gold's recent behavior remain mixed. The metal has faced pressure from a stronger U.S. dollar and rising bond yields, which typically weigh on non-yielding assets. However, geopolitical uncertainty and central bank demand continue providing some support, limiting immediate downside momentum.

Traders are closely monitoring macro data like U.S. inflation figures and Federal Reserve policy guidance, both of which can heavily influence gold's short-term direction.

What's Ahead for Gold

The focus stays on the wedge structure and the neckline test. If gold holds support around $4,000, a near-term bounce could develop—but failing to reclaim resistance at $4,300 would likely reinforce the bearish outlook. A clean breakdown could mark the beginning of a more significant correction phase after months of range-bound trading. Traders would likely view any sustained move below the neckline as confirmation of a trend reversal rather than just a temporary pullback.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov