● Stock Sharks recently shared that Robinhood is sweetening the deal for its Gold members with exclusive mortgage perks. Through a new tie-up with Sage Home Loans, the company is giving subscribers access to some of the lowest home loan rates on the market—another sign that Robinhood wants to be more than just a trading app.

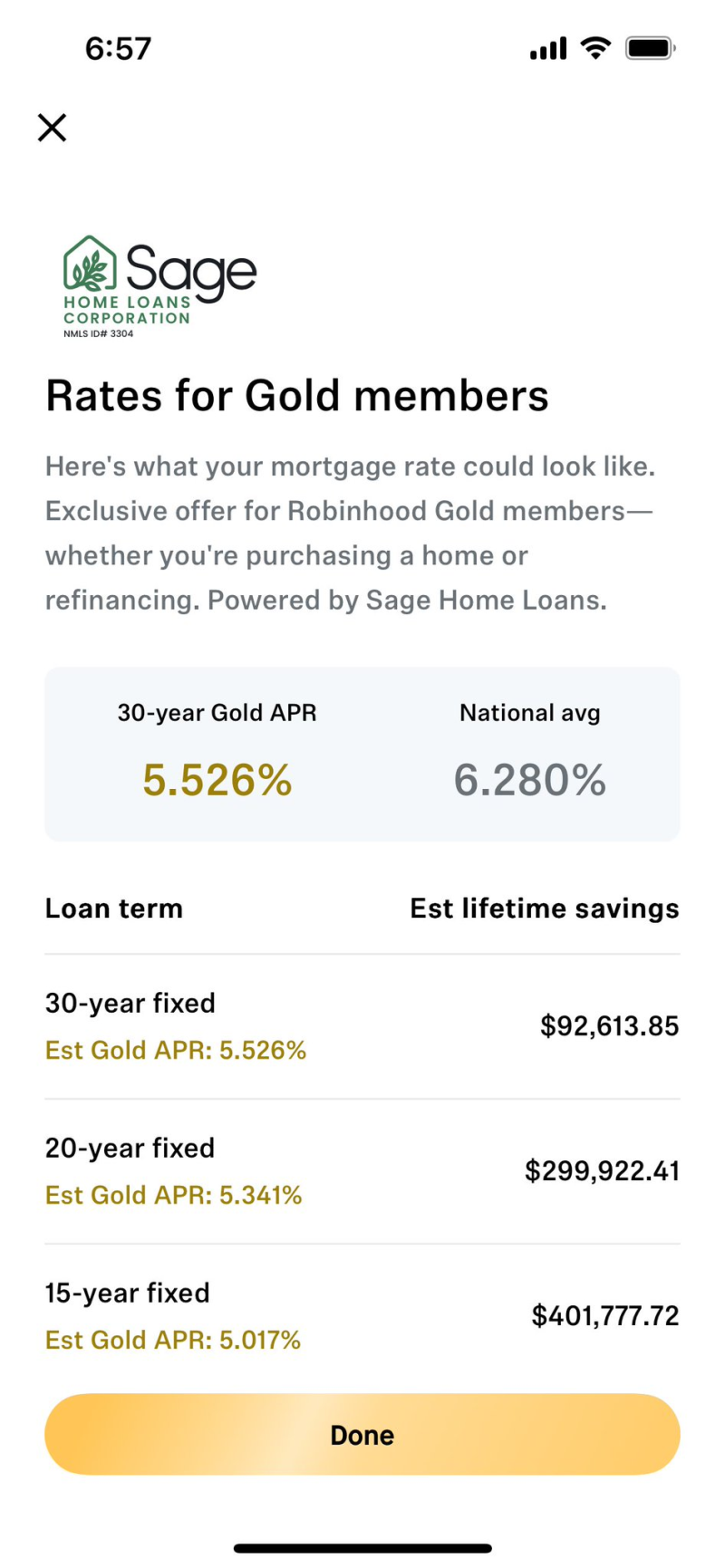

● The pitch is simple: help people afford homes when rates are still pretty high. Gold members can lock in a 30-year fixed rate at 5.526%, compared to the national average of 6.280%, plus save $500 on closing costs. It's a smart play for customer loyalty, though it does bring some risk—lending regulations, market swings, and long-term rate exposure could all become factors down the line.

● The savings potential is real. Sage estimates members could save over $92,000 across a 30-year mortgage compared to standard rates, or even more than $400,000 on a 15-year loan, depending on the amount borrowed. It's all part of Robinhood's bigger plan: turn Gold into a one-stop shop for investing, borrowing, and banking.

● This move also shows how fintech companies are increasingly stepping into traditional banking territory. With mortgage rates still elevated nationwide, Robinhood's ability to offer better terms through partners like Sage puts it in direct competition with platforms like SoFi and Revolut that already mix investing with lending.

Robinhood Gold members can now access exclusive mortgage perks — including some of the lowest rates available and $500 off closing costs — through a new partnership with Sage Home Loans. As Stock Sharks put it

● It's a clear signal that Robinhood is doubling down on keeping users engaged while pulling in people who want more than just stock trades.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi