What began with Bitcoin as a revolutionary peer-to-peer electronic cash system has evolved into a sprawling ecosystem of decentralized finance (DeFi), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs). This transformation has forced academic and professional spheres to recognize digital assets not merely as speculative instruments but as complex, multifaceted objects of analysis. Examining the underlying blockchain technology, the intricate market dynamics, and the sweeping regulatory implications requires a new level of interdisciplinary scrutiny. For students and researchers, engaging with this subject matter presents a unique challenge: synthesizing cutting-edge computer science with established principles of economics, law, and social science to form coherent, authoritative arguments.

Why Digital Assets Demand Scholarly Attention

The rapid pace of innovation within the digital asset landscape necessitates ongoing scholarly review and evaluation. A single decentralized application (DApp) often embodies complex elements of monetary policy, distributed consensus, and legal jurisdiction simultaneously, overwhelming traditional analytical frameworks. For many students tackling this intersection of disciplines for the first time, mastering the nuances of blockchain, cryptography, and market structure can be a daunting task. When faced with the pressure of high academic expectations and a topic that shifts daily, it is understandable that some might seek professional guidance, even considering, "I need help to write my essay for me via EssayHub." The foundational difficulty lies not only in understanding the technical mechanisms but also in contextualizing them within the broader framework of global finance. Digital assets defy neat categorization as traditional securities, commodities, or currencies; they possess characteristics of all three, creating ambiguities that fuel both market volatility and legal debate. Understanding this essential lack of established identity is the first step toward effective analysis.

The analytical demand for digital assets spans various fields. Computer science addresses the efficiency and security of consensus algorithms (Proof-of-Work vs. Proof-of-Stake). Economics grapples with programmable money, on-chain transaction velocity, and the macroeconomic impact of deflationary models. Law and governance contend with cross-border regulation and the legal status of smart contracts. This overlap ensures that comprehensive academic study requires a diverse interdisciplinary toolkit; ignoring this complexity risks reducing a profound technological shift to a simple market trend.

Furthermore, the philosophical and societal implications of decentralization are ripe for analytical exploration. The shift away from centralized authorities—such as banks, governments, and intermediaries—in favor of trustless, automated systems challenges fundamental ideas about power, trust, and accountability. Essays can explore whether this shift genuinely democratizes finance or merely centralizes power in a new class of technological elite. The rise of community-governed protocols and decentralized autonomous organizations (DAOs) presents real-world examples of alternative governance structures that warrant rigorous research in political science and sociology.

Key Analytical Lenses

Analyzing the digital asset space requires a departure from purely qualitative or purely quantitative methodologies. True insight emerges from marrying technical data with contextual analysis. One powerful lens involves dissecting the core mechanism of the blockchain: the consensus model. An examination of Proof-of-Work, which underpins early models, immediately brings economic analysis into contact with environmental science, given the substantial energy costs associated with it. Contrasting this with Proof-of-Stake introduces game theory, as the analysis shifts to how actors are economically incentivized to validate transactions honestly to protect their staked capital. This kind of comparative technical analysis provides the backbone for any robust academic paper on distributed ledger technology.

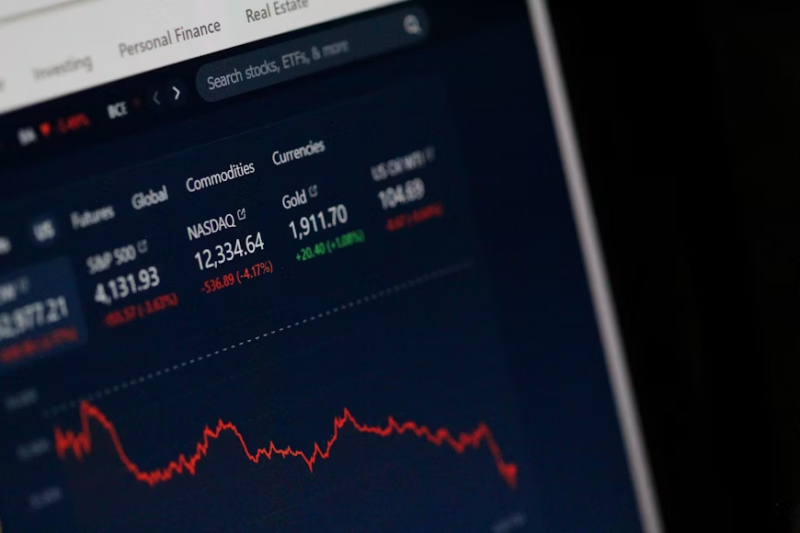

Another critical approach involves the study of on-chain metrics, which offer unprecedented transparency that is often obscured by traditional financial reporting. Data points such as transaction count, active addresses, and token distribution provide valuable insights into network health and user behavior. Analyzing the concentration of a token's supply among early holders, for example, provides insight into potential market manipulation and centralization risks that are essential for long-term stability. This data-driven investigation enables predictive modeling and trend analysis that are impossible with legacy financial assets.

Beyond the technical and data-driven perspectives, the behavioral economic lens is invaluable. Digital asset markets are highly susceptible to narrative and sentiment, phenomena often amplified by online communities. The analysis of "meme coin" cycles, for example, reveals more about social coordination, shared belief systems, and network effects than it does about fundamental value. Understanding these sociological drivers is crucial for a complete picture, as market behavior in this space is frequently a reflection of collective optimism, fear, and herd mentality rather than pure financial rationale.

Methodology for Digital Asset Research

The complexity of the subject matter makes the quality of the academic output particularly vital. Effective scholarly writing on digital assets demands precision, clarity, and an uncompromising commitment to factual accuracy. Given the rapid proliferation of speculative content in financial media, an academic essay must serve as an anchor of objective analysis. This necessitates meticulous sourcing, differentiating between primary sources (whitepapers and on-chain data) and secondary commentary. The argumentative structure must be logical and transparent, allowing the reader to follow the synthesis of technical detail and macro implications without getting lost in jargon.

The role of the academic essay writer in this context has undergone a fundamental change. They must act as an interpreter, translating highly technical concepts—such as zero-knowledge proofs or sharding—into language accessible to a multidisciplinary audience. A successful paper articulates the technology's function and its academic implications for the field of study. This requires distilling complexity into core principles, identifying specific research gaps in a fast-moving field, and proposing novel analytical approaches.

Furthermore, methodology in digital asset research is fluid. A paper on regulatory compliance might lean heavily on comparative legal analysis, examining how different jurisdictions (the EU's MiCA framework versus US securities law) are adapting. Conversely, an essay focusing on asset valuation must adapt discounted cash flow (DCF) models or network valuation models to account for factors like token burn rates, staking yields, and governance participation. The researcher's choice of methodology is thus critical, as it directly determines the validity and relevance of the final analytical conclusion.

The Real-World Impact of Digital Assets

Their financialization and potential returns dominate the global conversation surrounding digital assets. However, analyzing investments in this asset class requires a deep understanding of the unique, non-traditional risks associated with it. Beyond price volatility, investors face risks associated with smart contracts (code exploits), regulatory risks, and systemic risk from interconnected DeFi protocols. A comprehensive essay must explore how these non-financial, technical, and jurisdictional risks factor into rational investment decisions, analyzing market cycles and speculative bubbles.

The regulatory response to the rise of crypto assets is arguably the most significant external factor shaping their future. Central banks and global financial regulators are simultaneously exploring CBDCs while attempting to ring-fence the existing decentralized sector. This duality creates a complex political and economic environment. Academic work must track the evolving legislative landscape, assessing the effectiveness of proposed rules in protecting consumers without stifling innovation. The debate over treating digital tokens as securities or commodities has profound consequences for market structure, exchange compliance, and investor protections globally.

Ultimately, the analysis of digital assets is a lens through which we can understand the future of global finance and governance. Whether viewed as an inflation hedge, a new medium of exchange, or a foundational layer for Web3, cryptocurrency represents an evolving analytical object. For scholars, this demands constant updating of knowledge and a willingness to embrace interdisciplinary methodologies. The task of analyzing and communicating the impact of these complex digital instruments remains one of the most intellectually stimulating challenges of the current era.

Final Thoughts

Cryptocurrency has irrevocably changed the landscape of finance, technology, and academia, cementing its position as a new, high-stakes object of analysis. Mastering this topic requires a unique blend of technical literacy, economic insight, and strong analytical writing skills to bridge the gap between complex data and accessible scholarly discourse. From deconstructing consensus mechanisms to navigating global regulatory ambiguity, the subject demands rigor and adaptability. The work being done today in academic institutions will shape the public perception, legislative approach, and ultimate utility of digital assets tomorrow. The ongoing evolution of this space guarantees that the critical, expert analysis will remain essential for years to come

Editorial staff

Editorial staff

Editorial staff

Editorial staff