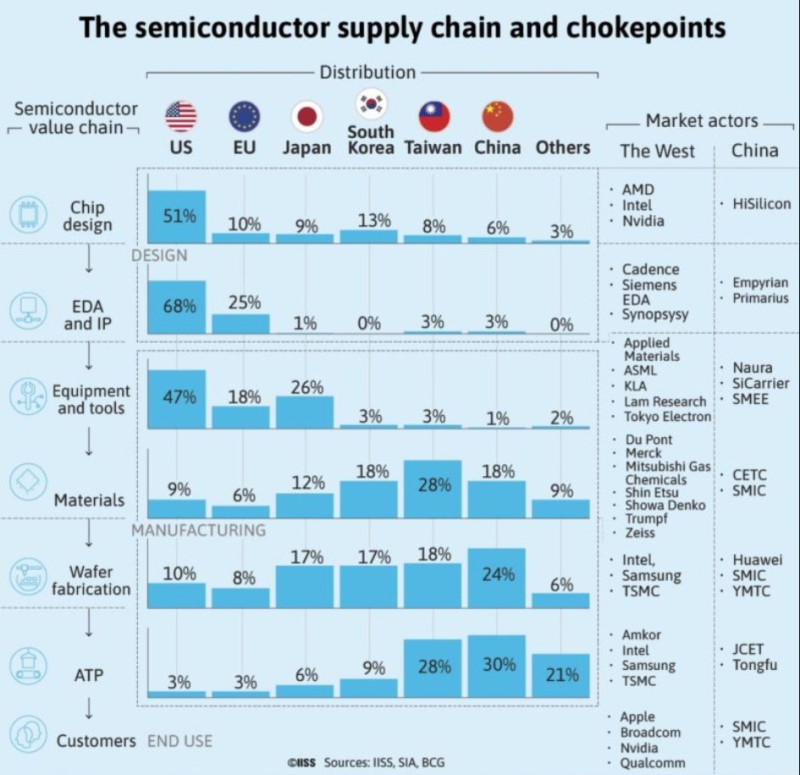

● In a recent analysis, Bourbon Capital broke down how the global semiconductor supply chain is carved up between regions, with each controlling different—and often irreplaceable—pieces of the puzzle. The United States has locked down the most critical early stages: chip design, EDA/IP software, and semiconductor equipment. Think Nvidia, AMD, and Intel on the design side, plus Cadence and Synopsys for the software tools that make chip design possible. On the equipment front, Applied Materials, Lam Research, and KLA give the U.S. a commanding position.

● Europe's footprint is much smaller overall, but it controls one absolutely critical chokepoint: ASML is the only company in the world that makes EUV lithography machines, which are essential for manufacturing the most advanced chips. That single monopoly gives Europe outsized influence despite its narrow focus.

● Asia, meanwhile, runs the manufacturing side of things. Taiwan and South Korea each hold about 17% of global wafer fabrication capacity—that's 34% combined—and China adds another 18%, giving the region clear dominance in production. When it comes to assembly, testing, and packaging (ATP), China leads with 30% and Taiwan follows closely at 28%, making them nearly equal powerhouses. Japan and Taiwan also control a big chunk of materials supply, at 18% and 28% respectively, which further cements Asia's leverage.

● What this all adds up to is a deeply interconnected system where no region can go it alone. Any serious disruption—whether from trade wars, export bans, or geopolitical tensions—could break critical supply lines and create economic and security problems that ripple across the entire world.

Usman Salis

Usman Salis

Usman Salis

Usman Salis