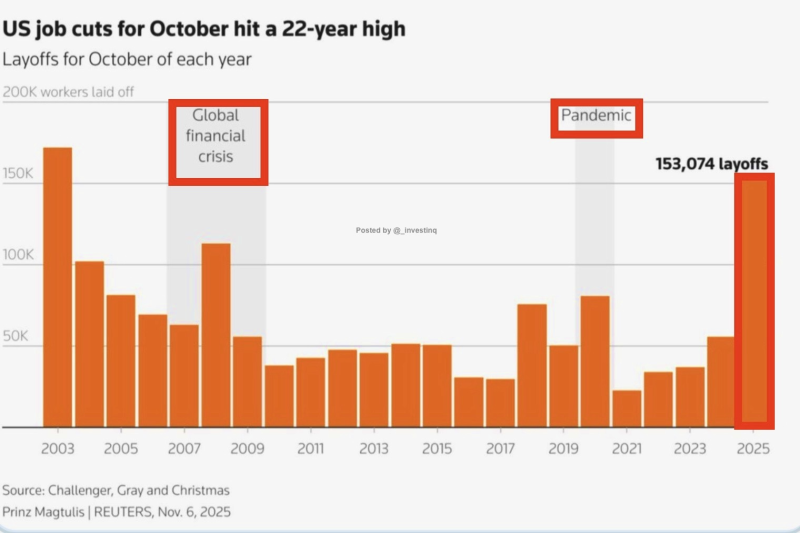

⬤ U.S. job cuts jumped to 153,074 in October 2025, the highest October total in over two decades. Unlike previous spikes during the early 2000s dot-com crash or 2008 financial crisis, today's layoffs aren't happening because the economy is falling apart. Corporate earnings are solid, people are still spending, and unemployment remains low. What's changed is how work gets done: companies have figured out they can maintain or even increase output with far fewer people, thanks to AI.

⬤ Washington is debating new tax policies around automation and workforce cuts. Ideas on the table include adjusting corporate tax breaks for labor-saving tech and creating disincentives for mass layoffs during profitable quarters. But these measures could backfire — tighter AI taxation might push struggling companies into bankruptcy, and a hostile regulatory climate could drive top tech talent overseas just when the U.S. needs to stay competitive in automation.

⬤ This shift isn't limited to tech. Companies that hired aggressively during the pandemic are now scaling back as AI handles tasks that once required human workers. The trend is spreading across finance, consulting, logistics, and customer service. With inflation still high and borrowing costs up, cutting headcount has become the quickest way to protect profit margins. Many firms are also restructuring ahead of a potential 2026 slowdown.

⬤ The job market is resetting. Workers face tougher conditions, but the flip side is booming demand for AI infrastructure, automation software, workforce optimization tools, and transformation consulting. Companies everywhere are racing to do more with less, creating major opportunities in industries built around that shift.

Peter Smith

Peter Smith

Peter Smith

Peter Smith