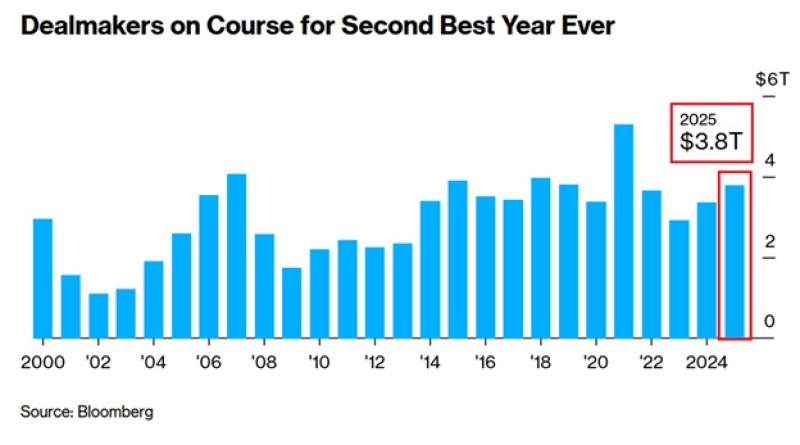

⬤ Global merger and acquisition activity is having an exceptional year, with total deal volume reaching $3.8 trillion so far. This puts 2025 on track to become the second-best year ever for dealmaking, just behind 2021's peak. The numbers show how aggressively companies are moving to grab strategic assets in today's fast-changing business environment.

⬤ The rebound looks even more impressive when you compare it to 2024, when M&A volume sat at $2.8 trillion—roughly 36 percent lower at this same point. The jump reflects a wave of massive deals across tech, healthcare, finance, and industrial sectors. AI has become the main driver behind these acquisitions, with companies scrambling to expand their computing power, data infrastructure, and product offerings. The year is also set to record the most $30 billion-plus deals since 2000, showing that big players are confident about making long-term bets again.

⬤ What makes this particularly interesting is how far above normal levels the activity sits. Major corporations, private equity firms, and tech giants have all jumped back in after being cautious during recent economic uncertainty. Easier financial conditions, higher stock valuations, and exploding demand for AI infrastructure have created one of the busiest M&A markets in decades. Companies are clearly willing to spend big money to stay competitive and speed up their strategic shifts.

⬤ This M&A surge matters because it shows how capital is flowing globally, how corporate strategies are evolving, and just how much AI is reshaping nearly every industry. The rapid growth in AI investment is transforming tech supply chains and driving consolidation among chipmakers, cloud platforms, and software companies. If this pace continues, 2025 could mark a turning point in how corporations spend money, compete for innovation leadership, and position themselves for growth in an AI-driven economy.

Usman Salis

Usman Salis

Usman Salis

Usman Salis