By late 2025, the world's largest tech companies have reached unprecedented valuation equilibrium. Apple, Microsoft, Nvidia, and Amazon now trade within a narrow forward P/E range of 33-35×, a level of parity not seen in over a decade. This convergence signals that investors now view Big Tech as mature, stable enterprises rather than wildly different growth stories.

Patient Investor's Analysis Reveals Valuation Shift

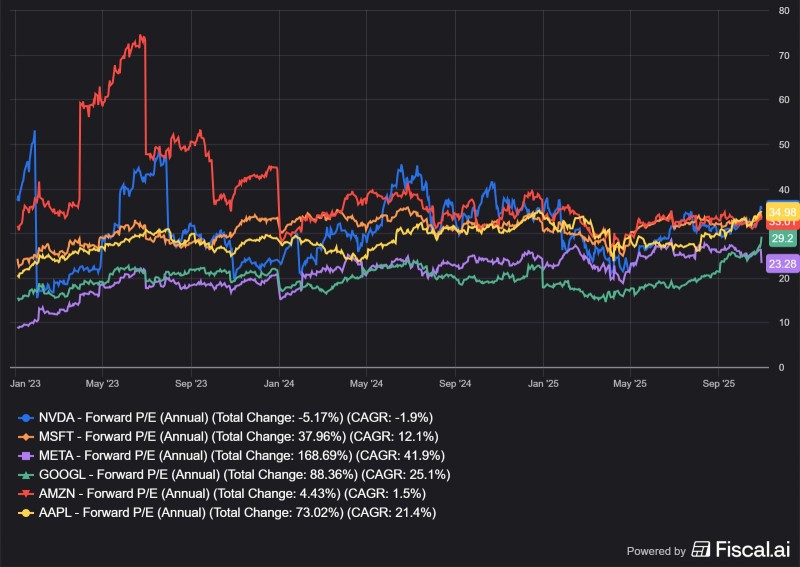

Financial markets analyst Patient Investor recently shared data from Fiscal.ai tracking forward P/E ratios for six tech giants—Apple, Microsoft, Nvidia, Amazon, Alphabet, and Meta—from January 2023 through October 2025. The chart reveals a dramatic convergence, particularly for Nvidia, which traded at more than double its peers during the 2023 AI chip boom.

The late 2025 snapshot shows Apple at 34.98×, Nvidia at 34.00×, Microsoft at 33.01×, and Amazon at 33.00×, while Alphabet sits at 29.20× and Meta at 23.28×.

Understanding the Rebalancing

The data reveals several key shifts. Nvidia corrected sharply after peaking near 70× P/E in mid-2023, normalizing with a -5.17% total change as earnings caught up. Meta staged the strongest recovery at 168.69% (41.9% CAGR) through cost discipline and AI-powered advertising. Alphabet surged 88.36% (25.1% CAGR) as Google Cloud and Gemini AI strengthened its competitive position. Apple and Microsoft showed stability with 73% and 38% gains respectively, while Amazon trailed at 4.4% growth despite improving AWS profitability.

Forces Driving the Convergence

Several factors explain this rebalancing. AI has evolved from a premium differentiator to a baseline expectation across all major platforms. Profit growth has accelerated, with investors now rewarding consistent earnings and efficiency over speculation. Macroeconomic stabilization has prompted rotation into high-quality tech stocks. Most importantly, AI leadership has consolidated into defined roles: Nvidia owns chips, Microsoft dominates enterprise AI, Google controls search infrastructure, Apple leads devices, and Meta commands consumer engagement.

Market Implications

This convergence signals important shifts. The AI hype cycle has transitioned to an AI productivity phase where investors demand measurable returns. Big Tech stocks will likely move more in tandem, increasing stability while reducing stock-picking opportunities. Future outperformance will depend on execution and actual earnings acceleration, not narrative momentum.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov