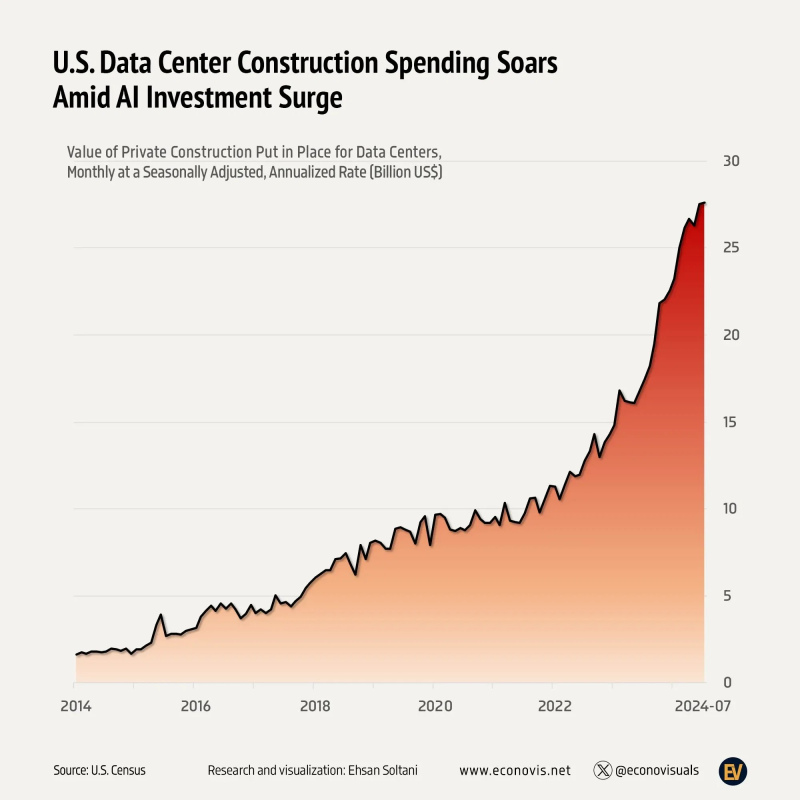

● The scale of AI investment is staggering. Microsoft, Alphabet, Meta, and Amazon plan to spend $370 billion on AI infrastructure in 2025 alone. U.S. data-center construction spending is approaching $30 billion annually, reflecting how fast the AI ecosystem is growing. Harvard economist Jason Furman estimates that data-center investment "accounted for nearly all US GDP growth in H1 2025"—AI infrastructure has become central to the entire economy.

● But physical reality is catching up. Lawmakers are considering higher taxes on power-hungry data centers to pay for grid expansion. Analysts warn this could bankrupt smaller operators, worsen power shortages, and drive talent overseas.

● Meanwhile, creative accounting raises red flags. Meta used a special-purpose vehicle to hide $27 billion of Louisiana data-center debt, then raised another $30 billion in corporate bonds. U.S. utilities requested nearly $30 billion in rate increases in the first half of 2025, directly hitting data-center operating costs. Hedgie also notes that tech firms are extending chip-life assumptions to six years—even though Nvidia ships new GPUs every two years—calling it "accounting manipulation to avoid profit hits."

● The U.S. added just 49 GW of renewable energy last year while China deployed 429 GW. Manufacturing shed 3,000 jobs and private employers added only 42,000, suggesting AI infrastructure is crowding out investment elsewhere. As Hedgie put it, we're watching "the physical constraint colliding with financial engineering"—a clash that could define the next decade of AI development.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah