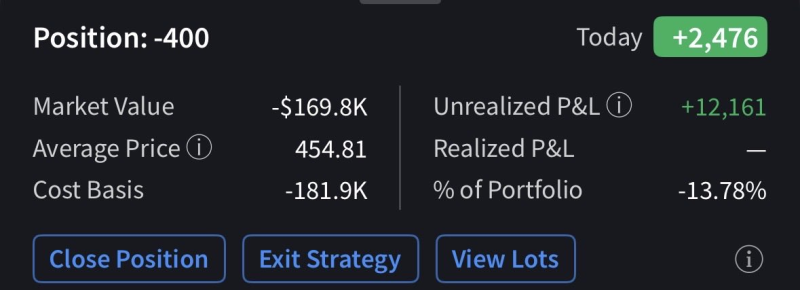

⬤ A recent trade update revealed a stop loss placed at $451 on a 400-share Tesla short position, currently showing over $12,000 in unrealized gains. The bearish stance sets a price target of $340, emphasizing fundamentals over sentiment as Tesla faces questions about its valuation amid increasing competitive and macroeconomic headwinds.

⬤ Broader policy discussions around corporate tax adjustments, capital gains treatment, and R&D deductions add fresh uncertainty to the EV sector. These potential changes could pressure automakers already dealing with high capital expenditures and thinning margins. Smaller EV companies face heightened bankruptcy risk if financing tightens, while increased taxation on stock-based compensation might accelerate talent drain from U.S. automotive engineering.

⬤ The trader plans to rotate profits directly into NIO stock, signaling a shift toward what he sees as stronger long-term value within the EV space. This move highlights the growing gap between Tesla's premium valuation and the evolving fundamentals across the global electric vehicle market, as rising volatility and policy uncertainty push more traders toward high-conviction short strategies.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi