Tesla (TSLA) shares continue their downward trend as investor concerns about CEO Elon Musk's role in Trump's Department of Government Efficiency outweigh optimism around the company's artificial intelligence initiatives.

TSLA Stock Drops Amid Broader Market Decline

Shares of the electric vehicle maker were falling 2.4% in premarket trading at $256.69, while S&P 500 and Dow Jones Industrial Average futures were down 0.5% and 0.4%, respectively. This latest decline adds to Tesla's ongoing struggles in the market, with investors hoping for a rebound as political uncertainties potentially subside.

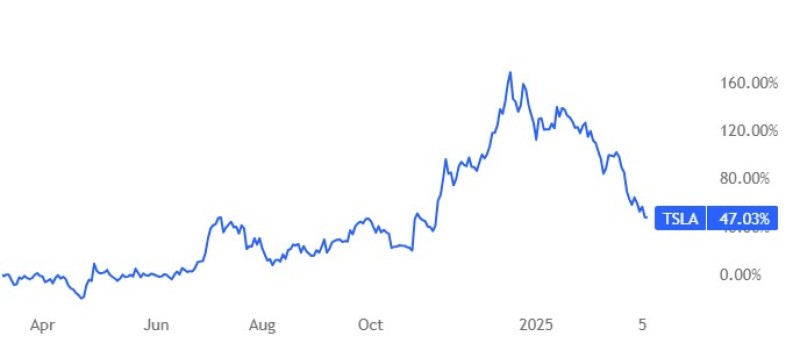

Tesla (TSLA) Down 26% Since DOGE Search Peak

Coming into Monday trading, TSLA stock had plummeted approximately 26% since February 20. Interestingly, this date coincides with the peak of Google searches for "DOGE" over the past 90 days. The acronym even outpaced searches for "Tesla" on that same day, highlighting the significant public attention on Musk's political involvement rather than the company's core business.

DOGE Controversy Creates New Risk Factor for TSLA Investors

Tesla CEO Elon Musk's role in President Donald Trump's newly created Department of Government Efficiency (DOGE) has stirred considerable controversy. This political entanglement has resulted in protests against both DOGE and Tesla, creating a new layer of uncertainty and risk that investors must now factor into their TSLA valuations.

Tesla (TSLA) Bulls Point to AI Future Beyond DOGE Concerns

Despite current challenges, some analysts remain optimistic about Tesla's long-term prospects. Wedbush analyst Dan Ives maintains a Buy rating with a $550 price target for TSLA stock. In a Thursday note, Ives emphasized that investors will eventually need to look beyond DOGE-related issues, highlighting Tesla's potential to unlock trillions in value through AI applications in self-driving taxi services and humanoid robotics.

The ongoing DOGE situation presents a timing challenge for Tesla investors. While Google searches for DOGE might have peaked, which could provide some relief, the Department is expected to continue operations until July 4, 2026. This extended timeline suggests that DOGE-related sentiment could continue to impact TSLA stock for the foreseeable future.

For Tesla shareholders, the current market situation represents a frustrating distraction from the company's technological developments and business fundamentals. The stock's significant decline since February indicates that many investors are choosing to step back until there's greater clarity on how Musk's political role will affect his leadership at Tesla.

The contrast between Tesla's ambitious AI initiatives and the DOGE controversy highlights the complex dynamics facing the company. While Ives and other bulls focus on Tesla's technological potential, the market appears more concerned with governance and leadership questions in the near term.

As Tesla navigates this challenging period, investors will likely be watching for signs that the company can maintain its technological edge and market leadership despite the distractions. The eventual sentiment shift on DOGE could catalyze TSLA stock, but the timing remains uncertain, given the Department's extended mandate through mid-2026.

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah