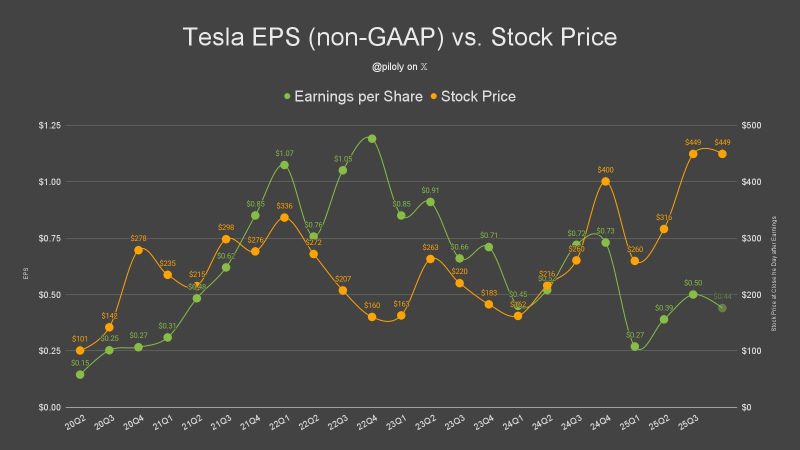

⬤ Tesla's getting ready to pull back the curtain on its Q4 2025 numbers this Wednesday, January 28, 2026 at 4:30 p.m. CT, and the stock's sitting right around where it landed after the last earnings call back on November 23, 2025. The company's non-GAAP earnings history tells an interesting story—EPS used to clock in above $1.00 in earlier quarters before cooling down to the current range.

⬤ Right now, analysts are circling around a $0.44 EPS forecast for the quarter. What's fascinating is how Tesla's share price has danced around these earnings figures—sometimes climbing toward the $400-$450 zone even when profits weren't exactly surging. The stock doesn't always follow the earnings script, which keeps things interesting for traders watching the setup.

⬤ With TSLA trading near recent peaks and expectations anchored at $0.44, Wednesday's report is shaping up as a major moment for one of the market's most-watched stocks. How the actual results and Elon's commentary stack up against current pricing could determine whether shares hold these levels or make their next move.

Peter Smith

Peter Smith

Peter Smith

Peter Smith