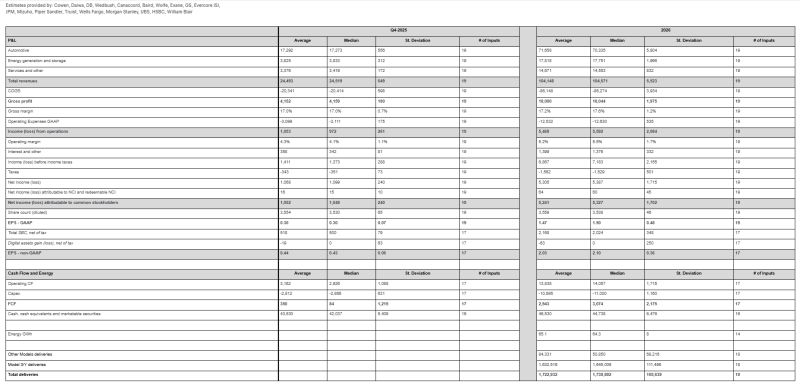

⬤ Wall Street's got some pretty specific numbers in mind for Tesla's upcoming earnings drop. We're talking about consensus estimates pulled from 19 analysts across the major financial shops, and these aren't official Tesla guidance—just what the Street thinks is coming. The company's set to report Q4 and full-year results on Wednesday, January 28, after the bell, so everyone's watching to see if reality matches up with expectations.

⬤ For Q4 2025, analysts are looking at total revenue around $24.5 billion. Here's how that breaks down: automotive bringing in roughly $17.3 billion, energy generation and storage adding about $3.8 billion, and services plus other stuff accounting for $3.4 billion. They're expecting gross profit near $4.2 billion—that's a gross margin hovering around 17 percent. Operating income should hit $1.0 billion, with net income to common shareholders at $1.05 billion. Bottom line? Analysts are penciling in $0.30 per share on a GAAP basis and $0.44 non-GAAP.

These consensus expectations serve as a key benchmark for the market ahead of Tesla's earnings announcement.

⬤ Looking at the full year 2026, the numbers get bigger across the board. Total revenue's projected at roughly $104 billion, with automotive revenue expected near $71.7 billion and energy generation contributing about $17.8 billion. Gross profit for the year? Around $18.0 billion, keeping that gross margin steady at 17.2 percent. Operating income should reach $5.5 billion, while net income to common shareholders is forecast at $5.2 billion. Full-year GAAP EPS is estimated at $1.47, with non-GAAP coming in near $2.03.

⬤ The real story here's whether Tesla can actually deliver on these numbers. Any big misses or beats versus what analysts expect could move the stock pretty hard in the short term and reshape how people think about Tesla's growth path, cost management, and profitability going forward into 2026.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova