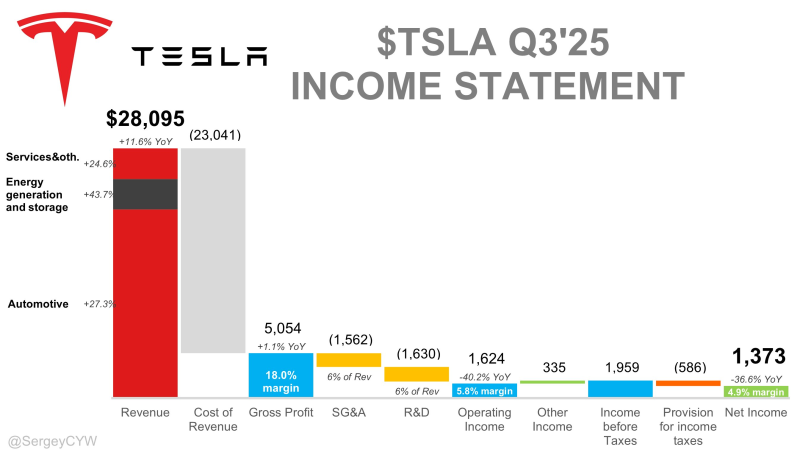

⬤ Tesla's Q3'25 financials paint a picture of a company betting big on AI while accepting short-term profit hits. Revenue climbed to $28.1 billion, up 11.6% from last year, powered mainly by automotive sales and a solid performance from the energy storage division. But here's the catch—operating income dropped 40.2% to just $1.62 billion, giving the company a thin 5.8% operating margin.

⬤ The profit squeeze is showing up across the board. Gross profit landed at $5.05 billion with an 18.0% margin, while the cost of doing business hit $23.0 billion. Meanwhile, Tesla's pumping roughly 6% of revenue each into sales, general, administrative costs, and research and development. That R&D spending tells you where Tesla's head is at—autonomy, software, and AI training are eating up resources.

⬤ Net income took the biggest hit, falling 36.6% year-over-year to $1.37 billion, which translates to a 4.9% net margin. Tesla's still making money, but barely compared to its former self. The company managed $1.96 billion in income before taxes, helped slightly by other income sources, but the main story here isn't about demand problems—it's about massive spending on future tech.

⬤ The real headline is Tesla's capital expenditure blowout: over $11 billion spent this quarter. After ditching the Dojo supercomputer project, Tesla went all-in on NVIDIA GPUs to power Full Self-Driving training at scale. This is a long game play—sacrificing today's margins to build tomorrow's autonomous driving platform. Whether that gamble pays off depends on how quickly Tesla can turn all this AI infrastructure into actual revenue from robotaxis and advanced driver assistance features.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah