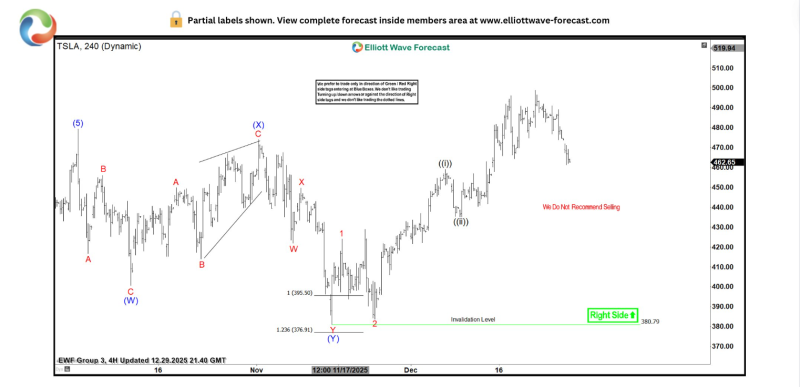

⬤ Tesla shares have climbed back up in recent trading sessions, hitting what market watchers call the "minimum expected bounce" in the current wave pattern. The stock pushed higher from its corrective phase, allowing traders who bought in earlier to move their positions into safer territory. As long as TSLA stays above the crucial $380 support zone, the upward momentum looks intact.

⬤ The stock chart tells an interesting story—Tesla bounced from its corrective W-X-Y pattern and surged past $500 before cooling off to current levels around $460. The technical setup still points upward, with the Right Side indicator suggesting there's more room to run.

⬤ What matters here is that Tesla hit the minimum target for this bounce, which means long positions have moved into what traders call "risk-managed" territory. Instead of being exposed to unlimited downside, these positions now have a clear line of defense at the $380 level. The medium-term outlook continues pointing higher.

⬤ Tesla remains one of Wall Street's most-watched stocks, and these Elliott Wave signals carry weight with trend-following traders. The big question now: can TSLA hold above $380 to keep the bullish structure alive? That support level will be the key marker everyone's watching in the weeks ahead.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets