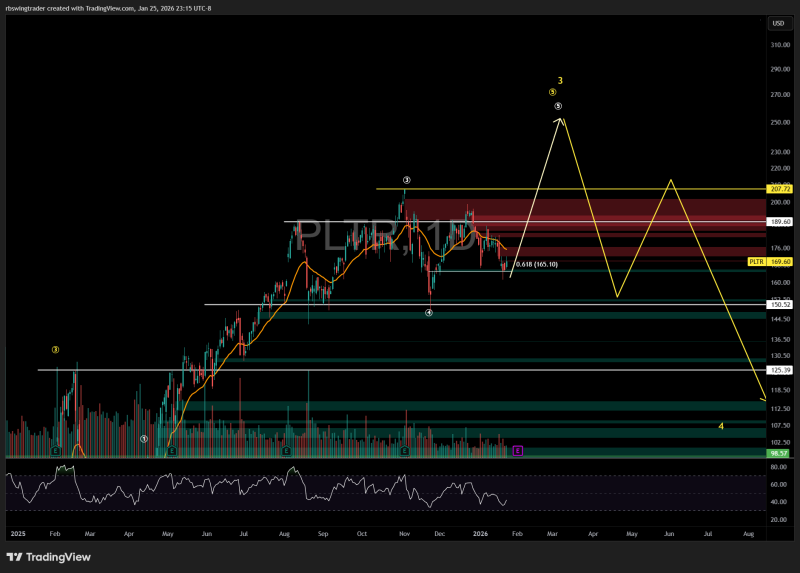

⬤ Palantir Technologies is trading right at a make-or-break support zone, with the stock hovering in the $165 to $162 range. After a strong run higher, PLTR has pulled back into this area and appears to be finding its footing. Recent price action shows candles stabilizing above the lower support boundary, and whether this level holds could determine what happens next.

⬤ The key retracement level sits near 165.10, which lines up closely with the bottom of the current trading range. Price has bounced off this spot, signaling it's acting as a near-term pivot point. What stands out is that PLTR hasn't collapsed after its earlier surge—it's consolidating instead. That sideways action keeps the door open for another leg up, assuming support doesn't crack.

⬤ The chart maps out a potential path that could take PLTR toward the 250 level and possibly higher, marking another peak in the broader uptrend. Previous resistance zones are clearly marked, showing where sellers stepped in before. The projection suggests any climb won't be smooth—expect some bumps and pullbacks along the way. But if the $165 to $162 zone gives way, the focus shifts to lower support levels and changes the outlook entirely.

⬤ Why this matters: PLTR's behavior around this well-defined support zone sets the stage for the next major move. Staying above this area would keep the bullish structure alive and suggest momentum remains on the side of buyers. A breakdown, though, would flip the script and bring downside risk into sharper focus. Right now, these technical levels are driving the action as the stock consolidates.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah