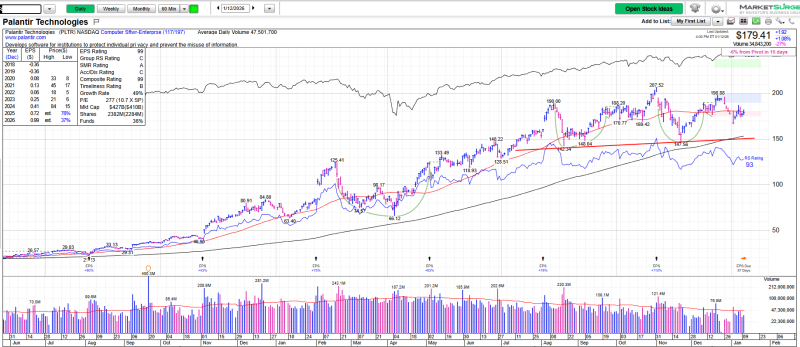

⬤ PLTR has been stuck in neutral for about five months now, going sideways after a solid run earlier in the year. The stock's just been grinding along without making much of a move in either direction. What looks like it could be a bearish setup to some traders is really just the stock taking a breather after its big push higher. The chart shows PLTR hanging above its longer-term support line, even though bulls haven't been able to push it much higher lately.

⬤ Here's the interesting part—while the stock's been going nowhere, the business itself keeps growing. Revenue's up about 10% since mid-year, which creates this weird gap between what the company's actually doing and where the stock's trading. PLTR keeps bumping into resistance at the top of its range, but buyers keep stepping in when it dips, creating this contained box that it can't seem to break out of.

⬤ The technical picture comes down to a few key numbers. Things start looking sketchy below the $166 area, which has been a pretty important floor during this whole consolidation phase. If it drops toward $147, that'd be a more serious red flag. On the flip side, the stock needs to push above the high-$180s to get things moving again—specifically above $187 to really get momentum going. Breaking past $199 would be the clearer signal that this sideways action is finally resolving higher, though right now it's still locked in that range.

⬤ This matters beyond just PLTR because it shows how even hot AI stocks can stall out. The company's riding strong tailwinds from enterprise AI adoption and defense spending, but the price action shows that even with good fundamentals, wide trading ranges demand respect. Until Palantir breaks above resistance or loses its support cushion, the stock's basically telling us that technical levels still call the shots in the short term.

Peter Smith

Peter Smith

Peter Smith

Peter Smith