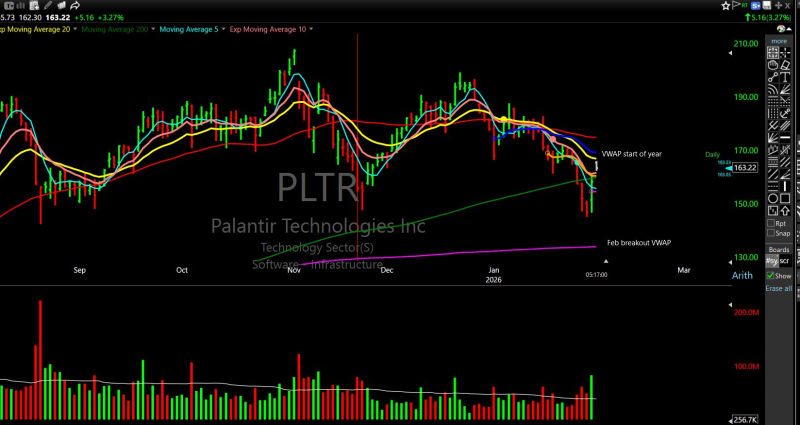

⬤ PLTR got a nice bump after Palantir dropped its latest earnings, but don't mistake the pop for a breakout. The stock's still pinned under a stack of declining moving averages—the 5-day, 10-day, 20-day, 50-day—and it hasn't cracked back above its year-to-date VWAP either. That's a lot of technical overhead for one stock to push through.

⬤ The chart tells the story: all those short-term averages are sloping down and sitting right above price, forming what traders call a resistance zone. PLTR bounced off recent lows, sure, but it hasn't reclaimed any of those declining levels yet. The 200-day moving average? That's rising and still below price, which is fine for long-term support but doesn't exactly scream "momentum trade."

Price action continues to sit below the year-to-date VWAP, a level often used to assess whether buyers are in control on a broader basis.

⬤ Volume did tick up after earnings—people noticed—but not enough to flip the script. PLTR's still under that year-to-date VWAP, and that matters. When a stock can't get back above that line, it's usually a sign that buyers aren't fully committed yet, even when the fundamentals look solid.

⬤ Here's the thing: post-earnings strength usually sticks when price lines up with the short-term trend. Right now, PLTR's fundamentals might be strong, but the technicals aren't cooperating. With all those averages declining and price still below VWAP, the recent rally feels more like a relief bounce than the start of something bigger. Smart money's probably waiting for a clearer setup—either a consolidation or one more dip—before jumping in with conviction.

Usman Salis

Usman Salis

Usman Salis

Usman Salis