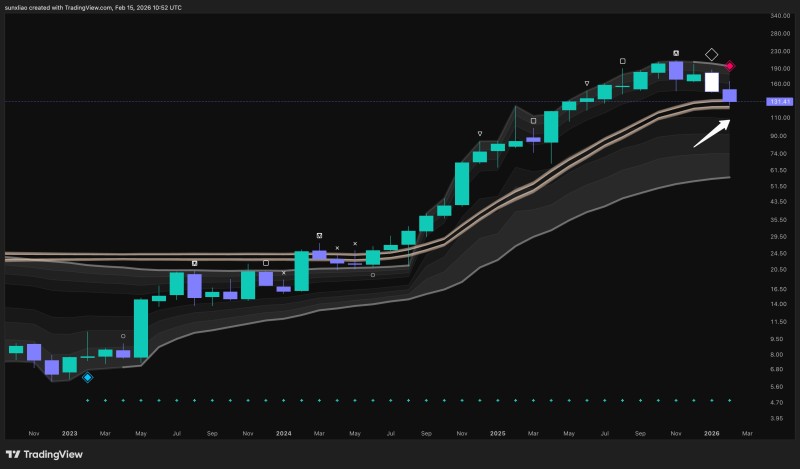

⬤ PLTR has pulled back to what traders are calling the "gold support zone" after months of climbing higher. The stock is now hovering right at a rising support band, and what happens next could set the tone for weeks to come. This gold support level serves as the key decision point that will likely determine where the stock heads from here.

⬤ After a strong rally, Palantir has entered a correction phase that's brought the price right down to the support structure that held it up during the climb. The current setup presents a clear fork in the road: if the stock holds above this level, bulls stay in control and the uptrend likely continues. But if it breaks below, bears could take over and push it lower. Similar pressure showed up recently when PLTR dropped below a key support at 110x forward earnings.

⬤ In other words, it's all about how the stock reacts right here, right now. Price action around this band will decide whether we see another leg up or a shift toward weakness. This mirrors the struggle seen when Palantir was trading below 5 key averages despite strong earnings numbers.

⬤ Why does this matter? Because major trend support levels like this one often act as directional gatekeepers. When a stock holds support, it signals strength and keeps the rally alive. When it fails, it opens the door to further downside and potentially changes the entire market narrative around the name.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov