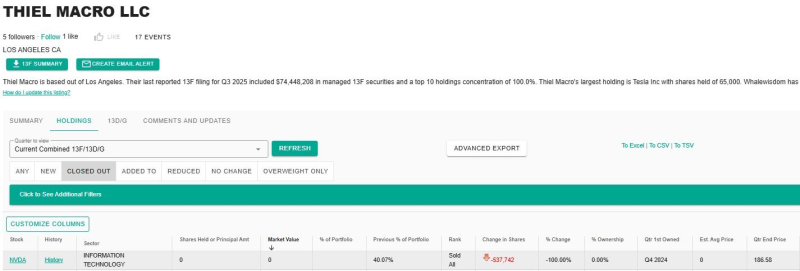

⬤ Nvidia grabbed fresh attention after reports surfaced that Peter Thiel dumped his entire $100 million position in the company. This exit came right after SoftBank unloaded its $5.8 billion Nvidia stake last week. The filing shows Thiel Macro LLC completely removed NVDA from its portfolio, marking "Sold All" status with a reduction of 537,742 shares.

⬤ The filing confirms zero remaining shares and zero market value for the Nvidia position. What was previously a 40.07% portfolio allocation has been eliminated entirely. The documentation clearly shows NVDA no longer exists in the firm's active holdings.

⬤ Adding fuel to the fire, Michael Burry is now reportedly shorting Nvidia. While specific details about his position remain unclear, this move adds another layer to the mounting pressure on NVDA. Between Thiel's complete exit and SoftBank's $5.8 billion sale, questions are emerging about whether sentiment around AI stocks might be shifting.

⬤ These moves carry weight because Nvidia remains the flagship name in AI and semiconductors. When major players like Thiel, SoftBank, and Burry all move against a stock, it creates ripples across the market. The combination of exits and short positions is sparking fresh debate about AI valuations and whether the rally has room to run.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah