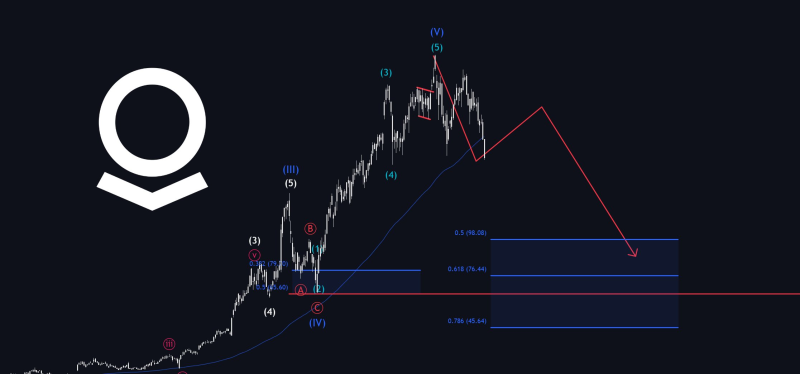

⬤ Palantir Technologies has shifted into correction mode after an explosive run-up, and the technical charts are now flashing red for what could be a serious downturn. The recent rally looks to have already peaked, leaving shares vulnerable to a much bigger pullback. Chart analysis shows a completed five-wave advance followed by early corrective patterns forming right at the highs.

⬤ Elliott Wave Analysis Points to $98 Target—A 50%+ Drop. The technical breakdown uses Elliott Wave theory on Palantir's long-term price movement, showing a finished Wave 5 climb and the start of a Wave 2 correction. These Wave 2 pullbacks typically eat up a large chunk of the previous gains. The Fibonacci levels marked on the chart point to potential support around $98—which would mean a decline of over 50% from the peak. That's exactly the kind of retracement you'd expect after an extended sentiment-fueled rally.

⬤ Chart Patterns Show Recovery Attempts Before Renewed Selling. The analysis reveals how earlier pullbacks played out during the broader uptrend, with corrective waves developing before each new leg higher. The projected path suggests an initial bounce attempt followed by more downside pressure—typical of complex corrections rather than straight drops. What's important here is that these corrections aren't necessarily driven by bad fundamentals, but by sentiment shifts after optimism hits extreme levels.

⬤ Why This Matters for the Broader Market. This setup carries weight because Palantir has become one of the most-watched growth stocks out there. When high-profile names like this correct sharply, it tends to shake overall risk appetite across the market. A deeper retracement would be a textbook example of how market psychology works in cycles—strong momentum phases regularly give way to sharp but technically normal pullbacks. The price structure shows how sentiment-driven rallies can reverse even when the long-term story stays intact, making these corrective phases a standard part of market behavior rather than an exception.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi