Palantir (PLTR) stock soared 23% following strong Q4 results, driven by surging AI demand and robust revenue growth. The company’s expanding AI offerings and increased government contracts fueled investor optimism, reinforcing its position as a key player in the AI-driven data analytics sector.

Palantir (PLTR) Stock Rallies on Robust Q4 Performance

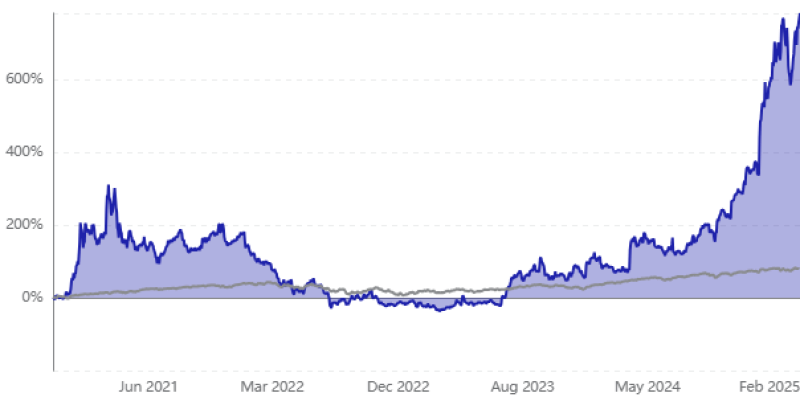

Palantir Technologies (PLTR) stock witnessed a remarkable 23% surge in after-hours trading on Monday after delivering stellar Q4 2024 earnings. The AI-driven software giant outperformed Wall Street expectations, showcasing impressive revenue growth across commercial and government sectors. As of 7:34 p.m. ET, PLTR was trading 22.6% higher, fueled by strong AI adoption and a bullish 2025 outlook.

AI Demand Drives Palantir (PLTR) Revenue and Earnings Growth

Palantir's Q4 2024 earnings report exceeded market projections, with revenue reaching $828 million, a 36% increase year over year. The company's U.S. commercial revenue soared 64%, alleviating investor concerns about its past reliance on government contracts.

- Adjusted earnings per share (EPS) of $0.11 beat expectations of $0.07.

- Revenue surpassed Palantir’s guidance range of $767-$771 million, significantly outperforming Wall Street’s estimate of $781.2 million.

- Cash flow from operations reached $460 million, marking a 53% annual increase.

- Adjusted free cash flow surged 70% to $517 million.

- Palantir ended Q4 with $5.2 billion in cash reserves and no long-term debt.

Despite an increase in stock appreciation rights (SARs) expenses, Palantir's underlying financial strength remains evident, with adjusted net income at $165 million.

Palantir (PLTR) CEO Highlights AI Revolution and Future Prospects

In his shareholder letter, CEO Alex Karp emphasized Palantir’s transformation into a dominant force in the AI sector. He stated:

“We are still in the earliest stages, the beginning of the first act, of a revolution that will play out over years and decades.”

Karp highlighted that Palantir is entering a new phase, combining the stability of an established tech giant with the agility of a startup. This outlook reinforces investor confidence in Palantir's long-term AI growth potential.

Palantir (PLTR) Provides Strong Guidance for 2025

Palantir’s Q1 2025 revenue guidance of $858-$862 million reflects a robust 35%-36% year-over-year growth. The company also expects adjusted income from operations between $354-$358 million, up 56%-58%.

This guidance significantly exceeds Wall Street's projection of $799.4 million in Q1 revenue, underscoring Palantir's accelerating AI adoption.

- The company closed 129 deals worth over $1 million.

- U.S. commercial total contract value (TCV) deals surged 134% to $803 million.

- U.S. government revenue rose 45% to $343 million, extending beyond defense into other federal agencies.

Conclusion

With strong financials and AI demand at an all-time high, Palantir’s trajectory suggests it could become the next tech giant. Some analysts believe PLTR could mirror Nvidia’s meteoric rise, positioning itself as a long-term leader in AI software solutions.

As AI adoption accelerates, Palantir's impressive growth, diversified revenue streams, and optimistic 2025 outlook indicate significant upside potential for investors.

Peter Smith

Peter Smith

Peter Smith

Peter Smith