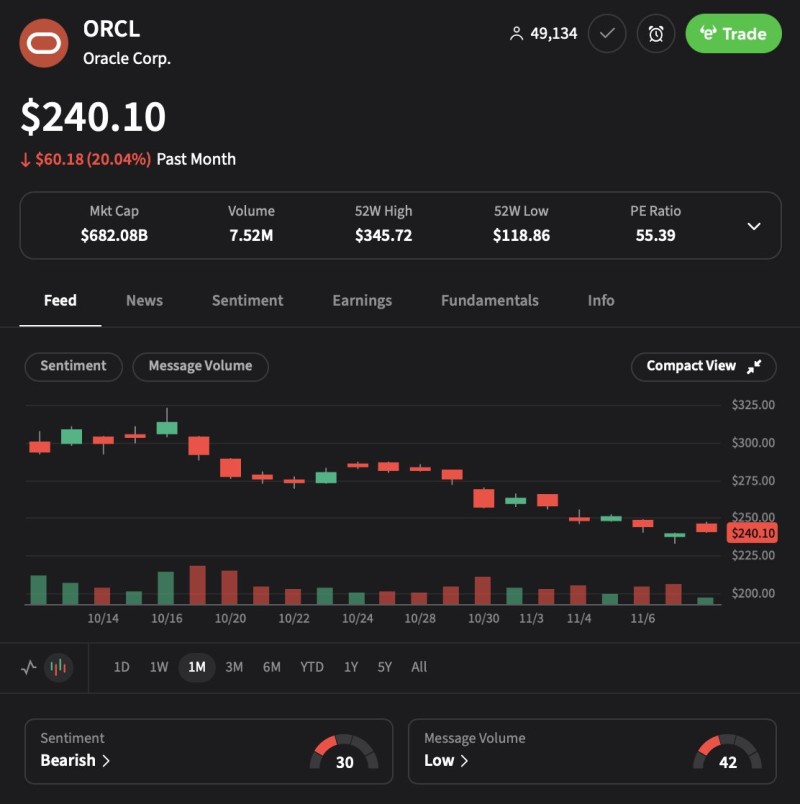

Oracle's stock is going through a rough patch, tumbling over 20% in the past month with little sign of recovery. As the price settles around $240.10, traders are watching to see if this is temporary or the start of something worse.

ORCL Extends Its Downtrend Amid Sustained Selling Pressure

The monthly chart tells a clear story—Oracle has been in freefall from the $290–300 range in mid-October. Each bounce attempt failed, creating lower highs that confirmed the downtrend.

The real damage happened when ORCL crashed through $250 on November 1st. That support level flipped to resistance, and now the stock is sitting at $240.10 with no signs of stabilization. Big red volume bars during the selloffs combined with weak green days show sellers are in control. The Bearish sentiment on Stocktwits confirms nobody's rushing to buy.

- Worries about slowing enterprise software spending are hitting the whole sector, and Oracle's cloud and database business makes it especially vulnerable to corporate budget cuts heading into 2025

- That sky-high PE ratio of 55.39 doesn't help—when you're priced for perfection and things start slipping, the fall can be brutal

- The competition in cloud and AI infrastructure keeps getting fiercer, and investors are questioning whether Oracle can keep pace with faster-growing rivals

Technical Outlook: Key Levels to Monitor

ORCL faces resistance at $250–260 after multiple failed breakout attempts. Support sits around $235–240, with $225 as the next level if that breaks. The trend stays bearish until buyers show up with real volume.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov