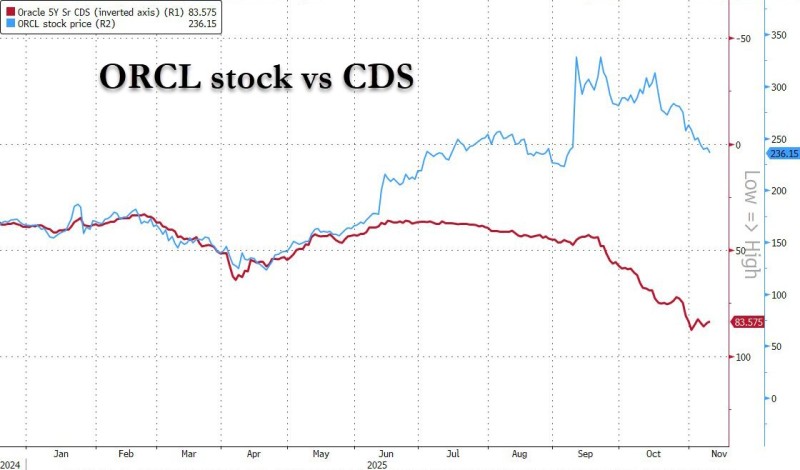

Something unusual is happening with Oracle right now. The stock's holding steady around $236, while its 5-year credit default swap spreads have dropped to just 83.6 basis points—nearly the lowest we've seen all year. What makes this interesting is the story these two markets are telling. Equity investors seem a bit nervous, but bond traders? They're feeling pretty good about Oracle's financial health.

What the Chart Reveals

Looking at the comparison between Oracle's stock price and its 5-year CDS, there's usually an inverse relationship—when confidence is high, CDS spreads tighten and stocks rally. But since August, that pattern's been breaking down.

CDS spreads keep falling, which normally suggests everything's fine on the credit side. Meanwhile, the stock has slipped from nearly $300 down to $236. Credit markets are saying Oracle's fundamentals look solid—strong cash flow, manageable debt, the works. But equity traders are pricing in concerns about slower growth in enterprise software and margin pressure in the cloud business.

The stock's decline fits into a broader rotation happening across big tech, as investors shift toward safer plays. Yet the CDS trend tells us bond markets aren't worried about Oracle's core financial strength. It's a split verdict, and an intriguing one.

The Bigger Picture

This kind of divergence isn't just an Oracle thing—it's showing up across several mega-cap tech names. CDS spreads have been tightening as yields stabilize, reflecting better credit conditions overall. Stocks, though, remain jumpy. Concerns about AI spending, cloud competition, and the broader economy are keeping equity markets on edge.

For Oracle specifically, debt investors seem reassured by the company's balance sheet strength and ongoing buyback program, even as the stock consolidates after a strong run. Part of this disconnect might also come down to interest rate expectations. As bond yields ease, corporate debt looks safer, compressing CDS spreads regardless of what's happening with the stock.

Key Takeaways and What's Next

- Divergence signals different confidence levels: Credit markets appear more bullish on Oracle's stability than equity markets right now.

- Technical support zone matters: The $230–$240 range is critical for ORCL—holding here could set up a recovery if fundamentals deliver.

- Next earnings will be telling: If Oracle posts solid results with AI-driven revenue growth, equity sentiment could catch up to what credit markets are already pricing in.

- No red flags on the credit side: The falling CDS spreads suggest no immediate concerns about Oracle's solvency or liquidity.

What It All Means

Oracle's stock-CDS split highlights a broader market tension right now. Credit markets are flashing green, while equity markets are flashing yellow. For investors, this gap could be an opportunity—if the credit market is right, the recent stock pullback might be overdone. But if equity traders are onto something, there could be more downside ahead as valuations adjust. Either way, how these two markets eventually align will likely determine Oracle's next big move. Right now, they're telling two very different stories, and it's worth paying attention to which one proves correct.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov