Oracle Corporation experienced a temporary improvement in credit market sentiment after announcing one of the largest corporate financing deals in recent history. However, the relief was short-lived, as credit default swap spreads have since returned to their previous peaks, raising questions about the sustainability of Oracle's aggressive data center expansion strategy.

$50 Billion Capital Raise Fails to Ease Long-Term Credit Concerns

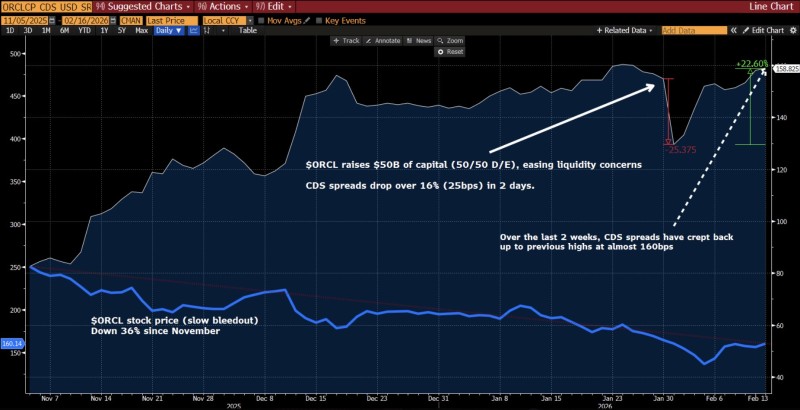

On February 1, 2026, Oracle raised $50 billion through a balanced structure of 50 percent debt and 50 percent equity. The financing was designed to address liquidity requirements and support the company's ongoing data center infrastructure buildout.

Initial market reaction appeared positive. Credit default swaps, which measure the cost of insuring against potential default, dropped approximately 16 percent within two days of the announcement—a decline of roughly 25 basis points. This suggested investors viewed the capital injection as reducing immediate credit risk.

However, the improvement proved temporary. Over the following two weeks, CDS spreads climbed back toward previous highs, approaching nearly 160 basis points. This return to elevated levels indicates the market remains skeptical about Oracle's ability to manage the financial strain associated with its capital-intensive expansion plans.

355% Spike in Credit Risk Over Past Year

The broader trend tells a concerning story. According to chart data, ORCL credit default swaps have increased approximately 355 percent over the past year. This dramatic rise reflects growing unease about the company's balance sheet amid massive infrastructure investments tied to cloud computing and artificial intelligence services.

Stock Performance Reflects Mounting Pressure

Equity markets have mirrored credit market concerns. Oracle shares have declined roughly 36 percent since November, coinciding with the period when CDS spreads began their sharp ascent. This parallel movement between credit risk metrics and stock performance underscores deepening investor caution around Oracle's expansion strategy.

The divergence between temporary credit relief and sustained equity weakness suggests the $50 billion raise has not materially altered fundamental perceptions about Oracle's financial trajectory. Previous analysis has highlighted rising Oracle CDS spreads and growing credit risk tied to AI expansion as persistent themes.

What This Means for Investors

CDS behavior serves as a real-time barometer of corporate stability. The fact that Oracle's spreads returned to elevated levels shortly after a major financing event signals that market participants view the underlying credit pressures as unresolved. Combined with continued stock weakness—patterns previously discussed around key ORCL support level risk—the situation reinforces the connection between credit conditions and equity sentiment during large-scale infrastructure buildouts.

For investors monitoring Oracle, the return of CDS spreads to near-record highs despite fresh capital suggests the market remains unconvinced about the company's ability to execute its expansion plans without further financial stress.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi