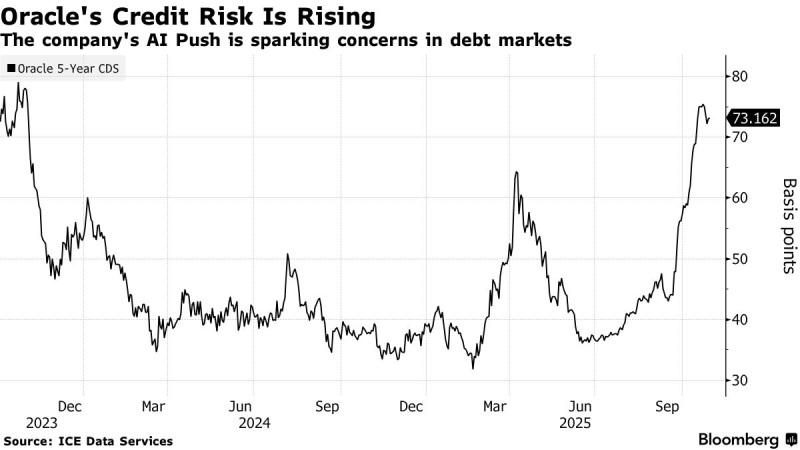

Oracle's big bet on artificial intelligence is starting to shake up credit markets. According to ICE Data Services, the company's 5-year credit default swaps (CDS)—essentially insurance against potential default—have climbed to 73 basis points, their highest point in nearly two years. The spike reflects growing concern among investors that Oracle's aggressive spending spree on AI infrastructure might stretch its finances thin down the road.

CDS Hits Two-Year High Amid AI Push

Bloomberg data shows Oracle's CDS spreads breaking out decisively after staying relatively calm through most of 2024. The spreads, which sat comfortably between 30 and 40 basis points for months, started climbing sharply around mid-2025 and have nearly doubled since June. Now sitting near 73 basis points, the spreads reveal the highest risk premium investors have demanded from Oracle in almost two years—a clear sign that the market's view of the company is changing fast.

The timing isn't coincidental. According to Wall St Engine, the repricing lines up with Oracle's debt-fueled expansion into AI data centers. Morgan Stanley estimates Oracle's net adjusted debt could balloon from roughly $100 billion today to nearly $290 billion by fiscal 2028. That's a massive jump that's prompted the bank to suggest hedging exposure through five-year CDS.

While Oracle is racing to secure its spot in the AI infrastructure game, the shift from lean software operations to capital-heavy data centers is putting real strain on its balance sheet. For bondholders, the worry is simple: what if these AI investments take longer than expected to pay off?

What the Numbers Tell Us

The Bloomberg chart breaks down the credit stress in three clear phases:

- Base Range (2023–mid-2025): CDS traded steadily between 30–45 bps, showing minimal credit worry

- Acceleration (mid-2025): Spreads broke above 60 bps as investors started rethinking Oracle's debt trajectory

- Current Level: Hovering around 73 bps with limited pullback, signaling a new, higher risk baseline

This isn't just a temporary blip—it's a sustained repricing that shows the market now sees Oracle as a riskier borrower than before.

Oracle's situation mirrors a trend playing out across the tech sector. Companies are loading up on debt to build AI infrastructure, betting big on future dominance even as borrowing costs stay high. It's a calculated gamble: spend heavily now to win later, but accept greater financial vulnerability in the meantime.

For Oracle—a company long known for steady software revenues and database reliability—this debt ramp-up is a departure from its traditionally conservative playbook. Whether the AI bet pays off remains to be seen, but for now, credit markets are clearly pricing in more risk.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah